Flashback: 1995 in the Housing Market vs Today

Reminiscing on 1995, one might recall a typical Thursday night watching Seinfeld (pre-DVR) and a Friday night hitting up the local Blockbuster to grab the latest release (was a double feature of Braveheart and Clueless the first "Barbenheimer?"). Their office computer might be running Windows 95, and the internet was in its infancy. Only 2% of home buyers looked for homes online that year—it was 100% last year. So why the comparisons to 1995? At 4.09 million, the annual pace of 2023's existing-home sales was the lowest number recorded since 1995, when it was 3.85 million. But, as clearly noted, the world was much different. This blog post aims to flesh out that 29-year comparison to see the changes and difficulties buyers faced last year.

In 1995, the population of the U.S. was 266.6 million. Today, the U.S. population is 336.0 million. So, you might ask, why are there so few home sales? That answer becomes clear when looking at both inventory and affordability. In December 1995, 1.58 million single-family homes were available to purchase compared to December 2023, with just 870,000 single-family homes. The months' supply in 1995 was 4.8 months compared to just 3.1 months in 2023.

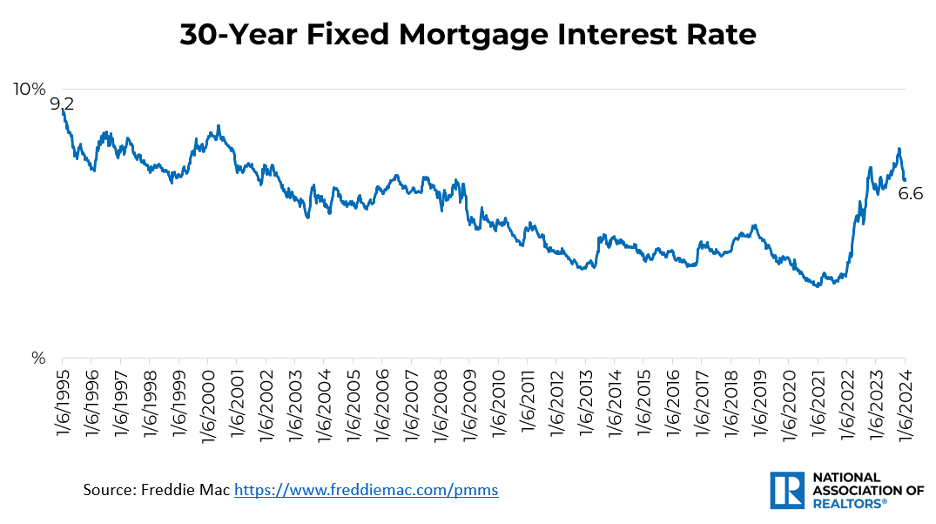

The second major hurdle is housing affordability. The median home sales price in 1995 was $114,600 ($227,826 inflation-adjusted). The median sales price in 2023 hit a historical high of $389,800. This is good news for homeowners and potential repeat buyers as they earn housing equity—but creates difficulties for new first-time buyers. In 1993, mortgage interest rates averaged 7.93%. In 2023, mortgage interest rates averaged 6.81%.

It's helpful to look at sales price and mortgage rates, not only in the context of overall housing affordability, but also in how far one's income can go when purchasing a home. In November 1995, the housing affordability index was 126.9 (above 100 is more affordable), the qualifying income to purchase a home was $32,112 (the same buying power as $64,192 in November 2023), and the mortgage payment as a percent of one's income would be 19.6%. All these factors have changed dramatically with limited housing inventory and the continual rise in home prices. In November 2023, the housing affordability index was 94.2, the qualifying income to purchase a home was $105,504, and the mortgage payment as a percentage of one's income would be 26.5%.

Given these measures of housing affordability and inventory, there should be no surprise that those who were able to purchase a home in 1995 were markedly different than today. The 1995 Profile of Home Buyers and Sellers shows that 42% of home buyers were first-time buyers. In 2023, the share was near historic lows at 32%. First-time buyers were younger at just 31 years old compared to 35 years today. Buyers today must save for longer periods while paying for debt that was not as common in 1995—student loans.

With all of this bleak data, was there anything good about 2023? Well, when comparing the share of buyers who used a real estate agent to buy a home in 1995, it was 81%; in 2023, the share rose to 89%. Perhaps this is not a surprise when the task buyers turn to agents for the most is finding the right home in this limited housing inventory environment.

The headwinds for the 2023 housing market were severe, but already 2024 is showing signs of encouragement. Mortgage interest rates are receding and expected to continue to do so throughout the year. There are buyers moving from the sidelines. New housing construction is bringing more inventory into the market. If all metrics continue to improve, 2024 should end on a better note for the housing market.

Categories

Recent Posts

5966 Fairview Rd, Suite 400, Charlotte, NC, 28210, United States