From Savings to Student Loans: The Financial Realities of Single Female Home Buyers

This past March, celebrating Women’s History Month, we published a blog post exploring the triumphs and challenges of female homeownership. Women of color often face systemic barriers, like limited access to good education, job opportunities, and affordable housing, that are rooted in both historical and ongoing racial discrimination. In another blog post, we looked more closely at who buys homes, the sociodemographic factors that influence home buying, and the ages at which single female home buyers enter the market.

Following up on our two previous posts, using data from the 2023 Profile of Home Buyers and Sellers, we will examine the different ways single female home buyers approach buying a home and the challenges they face. In this blog post, we’ll discuss their diverse financial strategies and the significant hurdles they encounter, like dealing with debt, student loans, and mortgage application denials.

Financing

Source of Down Payment

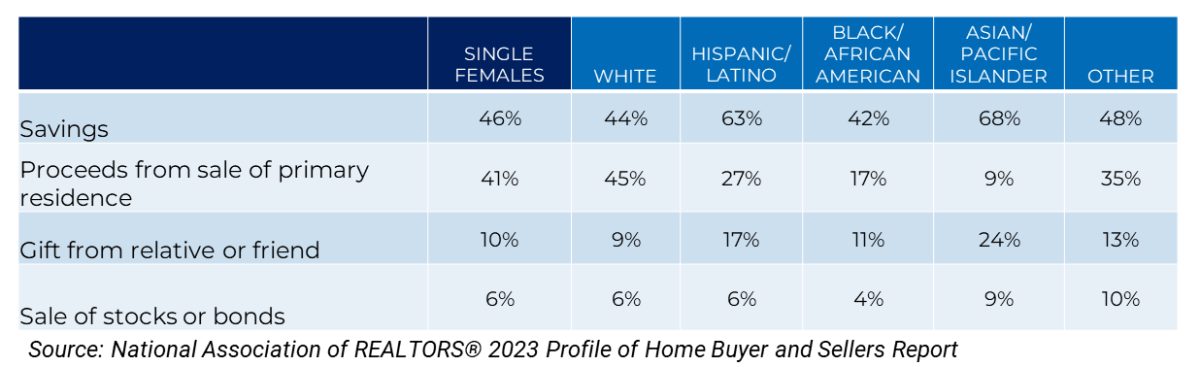

Forty-six percent of recent single female home buyers used their savings to finance their home purchases, highlighting the importance of personal savings in home buying for this demographic. The use of savings is particularly pronounced among Asian/Pacific Islander (68%) and Hispanic/Latina (63%) single female home buyers, who significantly surpass the average. In contrast, white single female home buyers were more likely to report they utilized proceeds from the sale of a primary residence than any other racial/ethnic group at 45%. This suggests that single white female buyers are more likely to have owned their previous residence and experience the associated financial benefits.

Asian/Pacific Islander (24%) and Hispanic/Latina (17%) single female home buyers were more likely to report using a gift from a relative or friend, indicating the significance of familial and social support in the homebuying process. This disparity highlights the varying financial dynamics and community support systems across different racial and ethnic groups in the context of home buying.

Debt

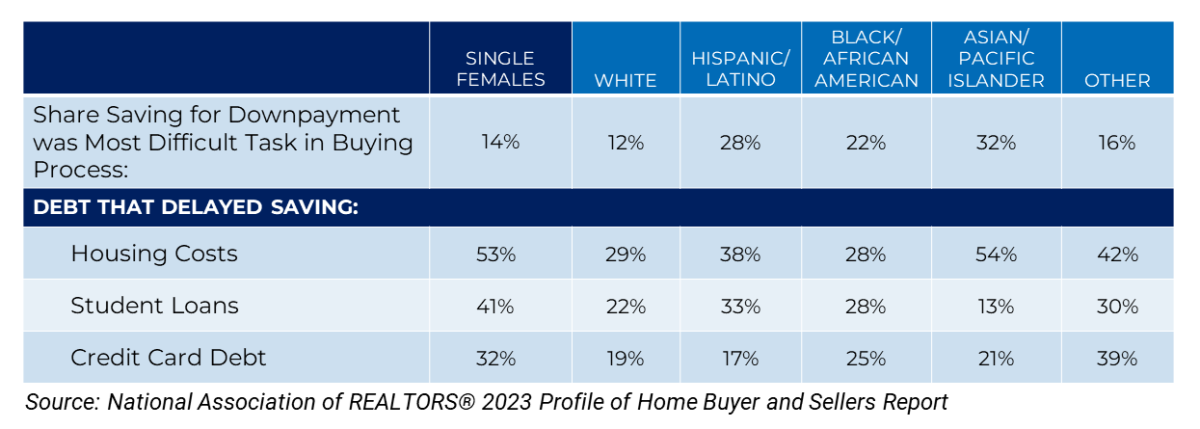

The percentage of single female homebuyers who found saving for a down payment to be the most difficult task varies significantly across racial and ethnic groups. Asian/Pacific Islander single female buyers reported the highest difficulty (32%), followed by Hispanic/Latina (28%) and Black/African American single female buyers (22%). White single female buyers (12%) reported the lowest difficulty saving.

Data from the 2023 Profile of Home Buyer and Sellers Report found that current rent and mortgage payments, student loans, and credit card debt were the primary debts delaying savings for single female home buyers. The impact was particularly pronounced among Asian/Pacific Islander single female buyers (54%). White single female buyers reported the least impact from rent and mortgage payments (29%).

Credit card debt affected saving efforts across all groups but varied in significance. Hispanic/Latina single female buyers (17%) and White single female buyers (19%) reported the lowest impact from credit card debt. The data indicates that saving for a down payment is particularly challenging for certain racial and ethnic groups of single female homebuyers, with housing costs and student loans being significant barriers.

Student Loan Debt

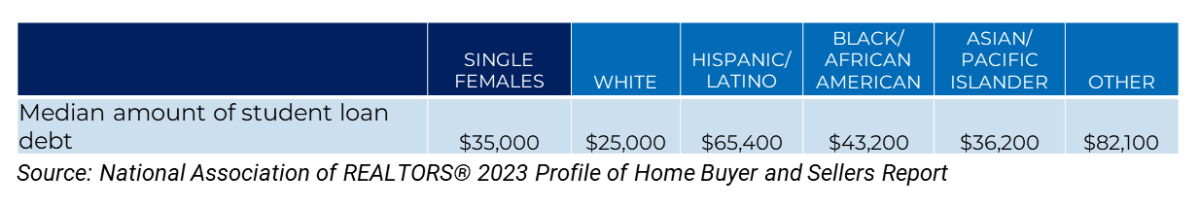

Student loans significantly impact many single female homebuyers. Hispanic/Latina buyers (33%) report the highest impact, while Asian/Pacific Islander buyers (13%) report the lowest. The median student loan debt for single female homebuyers is $35,000. White homebuyers have the lowest median debt at $25,000, while Hispanic/Latina homebuyers have the highest at $65,400, more than 2.5 times higher.

Mortgage Challenges/Accessibility

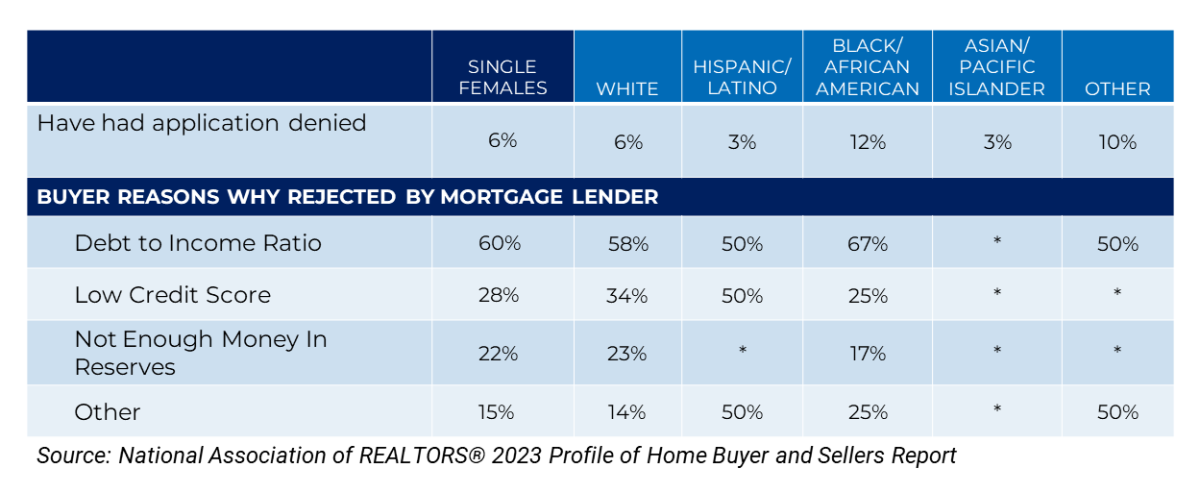

Six percent of single female home buyers reported having a mortgage application denied, underscoring the challenges faced by this demographic in securing home financing. Notably, Black single female buyers were more likely to experience a denied mortgage application than any other racial or ethnic group, with 12% reporting such rejections.

The top three reasons for mortgage application rejections among single female buyers were debt-to-income ratio, low credit score, and insufficient reserve money. Among these factors, a single woman's debt-to-income ratio was the most frequently reported reason for rejection across all racial and ethnic groups. Single Black women, in particular, reported this issue at an alarmingly high rate of 67%, which is significantly higher than the rates reported by other groups.

Overall, these statistics reveal significant racial and ethnic disparities in the homebuying process for single female buyers, pointing to the need for targeted interventions, policies, and programs to address these inequities and support more equitable access to homeownership.

Views on Homes as a Financial Investment

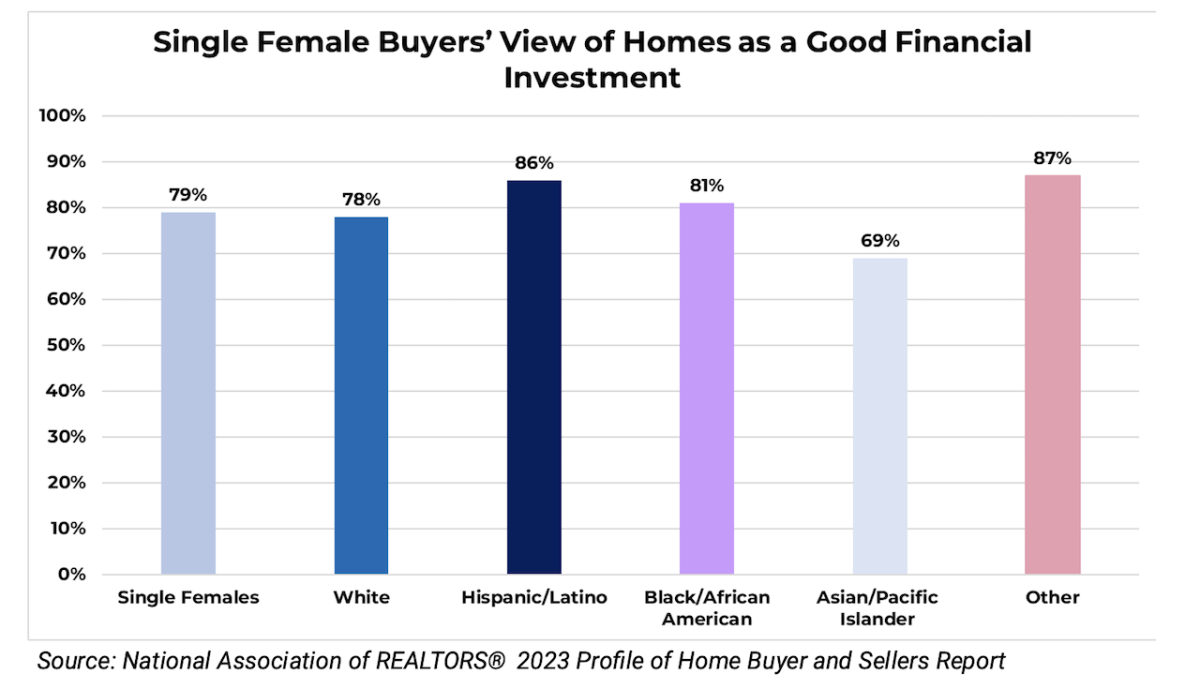

Nearly 8 in 10 single female home buyers consider buying a home a good financial investment. Hispanic/Latina single female buyers view homeownership as a good investment at the highest rate (86%), followed by Black/African American single female buyers (81%).

Personal savings are very important, but how much people rely on family support and previous home equity can differ greatly between groups. The struggle to save for a down payment, handle debt, and deal with mortgage rejections shows why we need solutions that fit different needs. Generational wealth can also play a huge role, affecting how easily people can get into homeownership. Since many buyers see owning a home as a smart investment, tackling these financial challenges and gaps is key to making homeownership fairer and more accessible for everyone.

Categories

Recent Posts

5966 Fairview Rd, Suite 400, Charlotte, NC, 28210, United States