Home Sales Dip as Prices Surge to New Highs

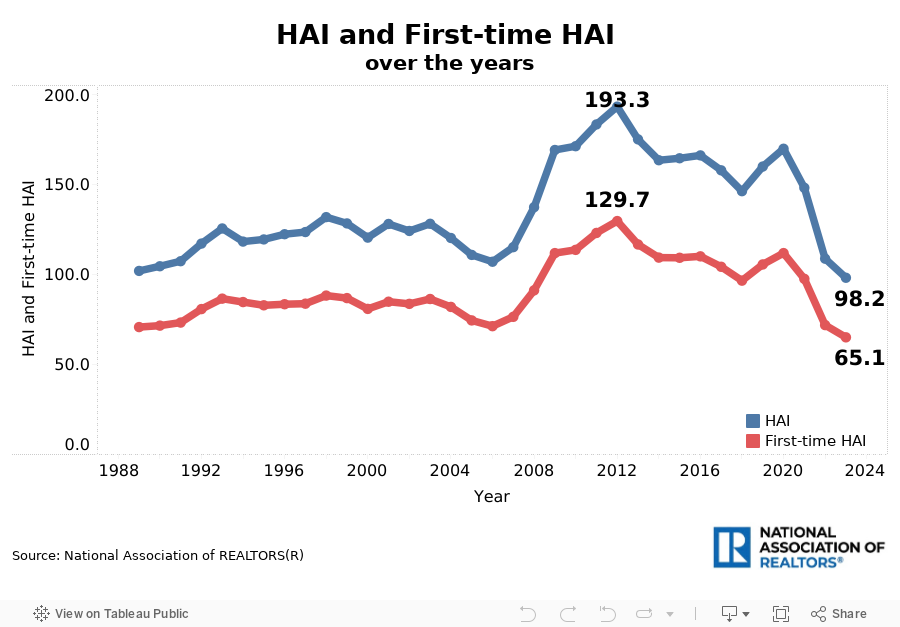

Existing-home sales fell to their lowest level in nearly 30 years in December—but that didn’t cool red-hot home prices, with the median price reaching an all-time high of $389,800, the National Association of REALTORS® reported Friday.

Existing-home sales—which include completed transactions for single-family homes, townhomes, condos and co-ops—declined 1% month over month in December and are down 6.2% compared to a year earlier, NAR’s latest sales index shows. But lower mortgage rates, which are now below historical norms, likely will set the stage for stronger sales in 2024, NAR predicts.

“The latest month’s sales look to be the bottom before inevitably turning higher in the new year,” says NAR Chief Economist Lawrence Yun. “Mortgage rates are meaningfully lower compared to just two months ago, and more inventory is expected to appear on the market in the upcoming months.”

But home buyers nationwide are still facing a dearth of options. Total housing inventory at the end of December was down 11.5% from November, remaining at historical lows. Many would-be sellers are reluctant to trade in their super-low mortgage rates from just a couple of years ago and make a move at today’s higher rates and home prices. This “lock-in effect” has been blamed for subduing housing inventory, along with sluggish new-home construction that economists say isn’t keeping pace with demographic needs.

With home prices continuing to surge, homeowners are watching their equity grow. Yun says 85 million homeowners saw gains in housing wealth last month. The average U.S. homeowner with a mortgage has built more than $300,000 in equity since their purchase date, according to CoreLogic’s equity report.

However, “the recent rapid, three-year rise in home prices is unsustainable,” Yun says. “If prices continue at the current pace, the country could accelerate into ‘haves’ and ‘have-nots.’ Creating a path towards homeownership for today’s renters is essential. It requires economic and income growth and, most importantly, a steady buildup of home construction.”

Homes Still Selling Fast, More Inventory Coming

Builders are trying to ramp up construction, but there are production swings from month to month. Housing construction fell 4.3% in December but remains above 1 million units, the Commerce Department reported this week. Single-family housing permits—a gauge of future construction—posted an uptick last month, indicating that more new inventory is on the way. Still, it’s likely to be a challenging year for new-home construction due to higher mortgage rates and tight monetary policy, says Alicia Huey, chair of the National Association of Home Builders.

“Moderating mortgage rates are expected to provide a boost to new-home construction in 2024, but an uptick in building material prices and a shortage of buildable lots and skilled labor are serious challenges for home builders,” adds Danushka Nanayakkara-Skillington, NAHB’s assistant vice president for forecasting and analysis.

In the existing-home market, homes continue to sell fast. Fifty-eight percent of those sold in December were on the market for less than a month, NAR’s latest research data shows. NAR has predicted a stronger housing market for 2024. Here are more key housing indicators from NAR’s December report:

- Days on the market: Properties typically remained on the market for 29 days, up slightly from 26 days a year earlier.

- First-time home buyers: First-time home buyers comprised 29% of sales, down from 31% in November.

- All-cash sales: All-cash sales comprised 29% of transactions, up slightly from last year’s 28%. Individual investors and second-home buyers make up the biggest bulk of all-cash sales, accounting for 16%, NAR’s data shows.

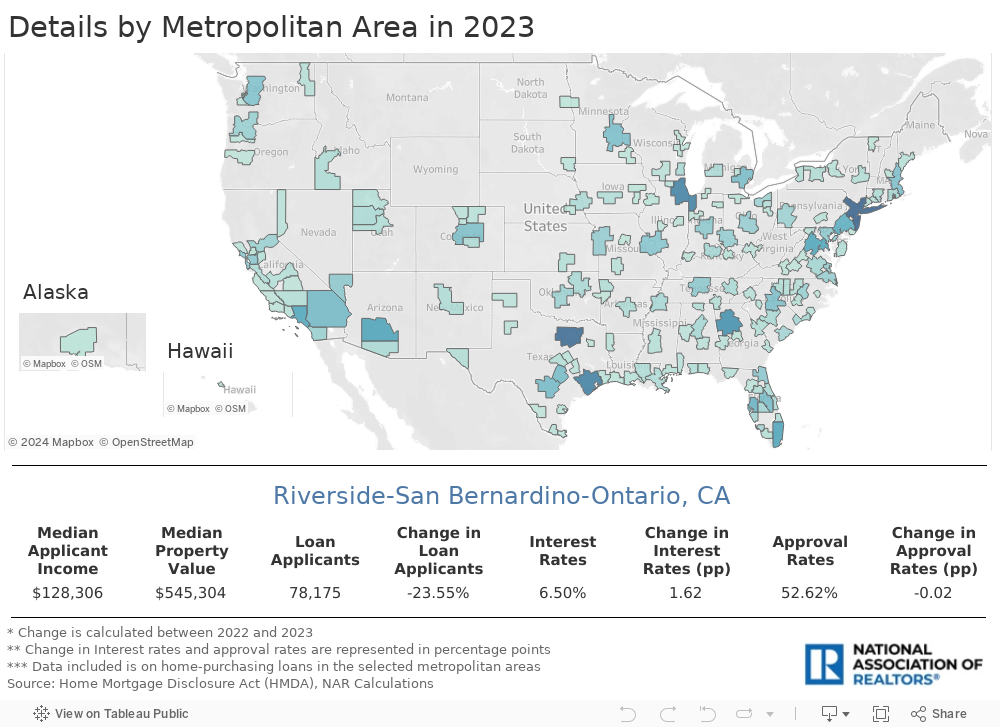

Regional Breakdown

The following is a closer look at how existing-home sales fared across the country in December:

- Northeast: Sales remained flat compared to November but were down 9.6% compared to a year earlier. Median price: $428,100, up 9.4% from the previous year.

- Midwest: Sales fell 4.3% from the prior month, reaching an annual rate of 900,000. Sales are down 10.9% from last year. Median price: $275,600, up 5.9% from December 2022.

- South: Sales fell 2.8% from November to an annual rate of 1.72 million. Sales are down 4.4% when compared to the prior year. Median price: $352,100, up 3.8% from one year ago.

- West: Sales rose 7.8% from a month ago, reaching an annual rate of 690,000 in December. Sales are down 1.4% from the year prior. Median price: $582,000, up 4.8% from December 2022.

Categories

Recent Posts

5966 Fairview Rd, Suite 400, Charlotte, NC, 28210, United States