Housing Affordability Weakened in February 2024

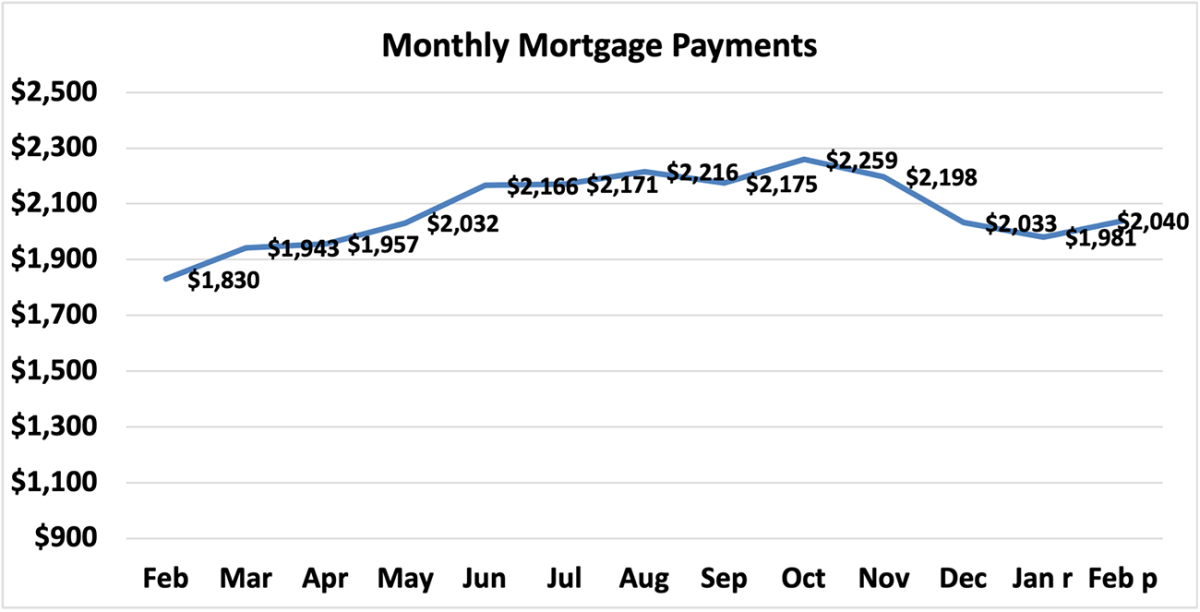

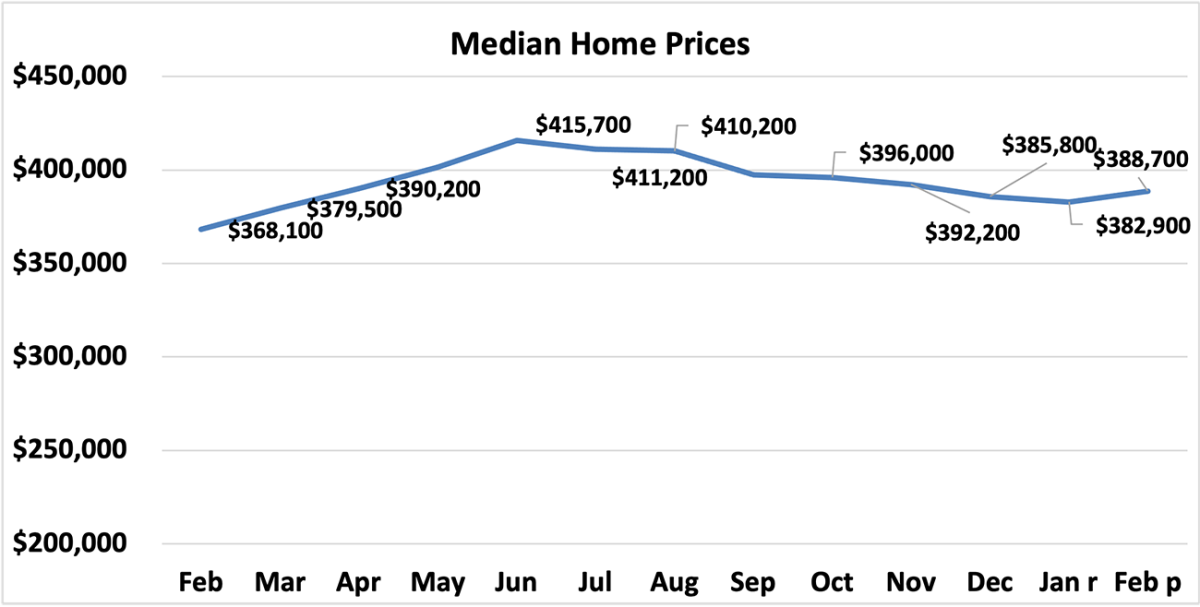

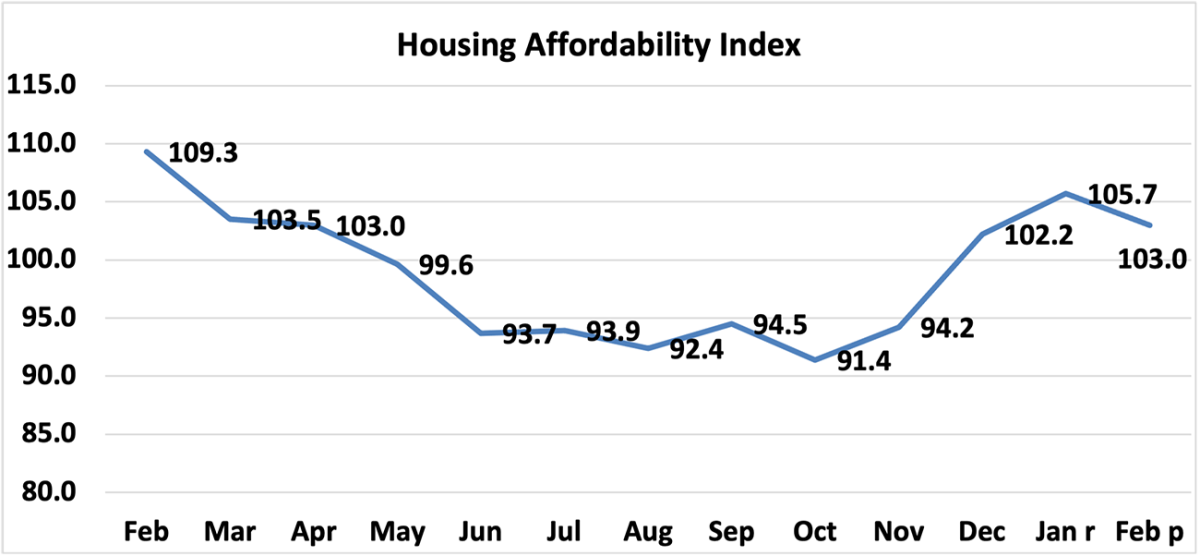

According to NAR's Housing Affordability Index, housing affordability declined nationally in February compared to the previous month. The monthly mortgage payment decreased by 3.0%, while the median price of single-family homes declined modestly by 1.5%. The monthly mortgage payment decreased by $59 from last month.

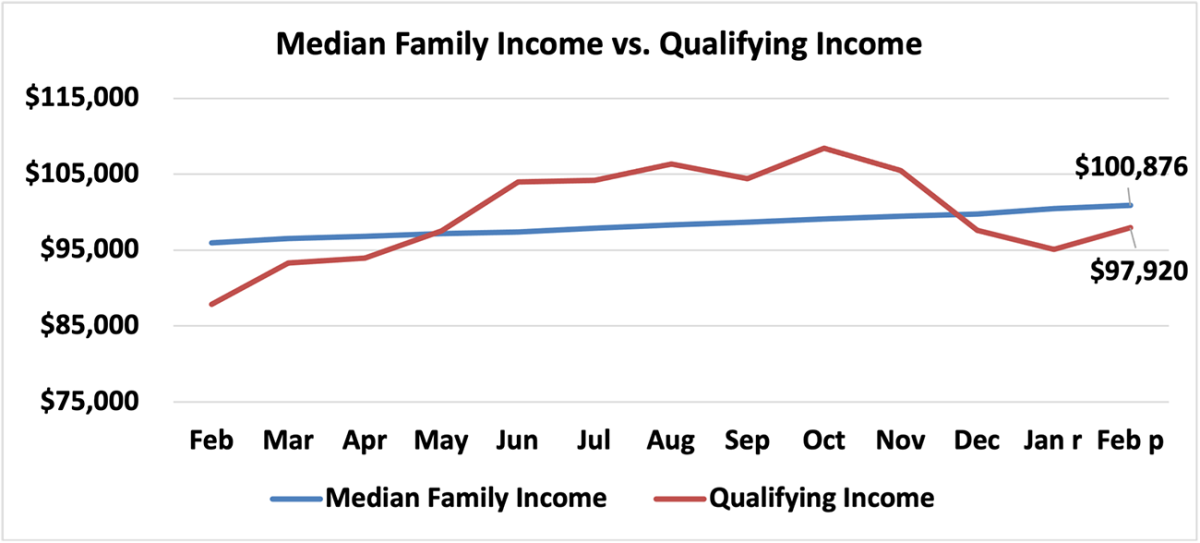

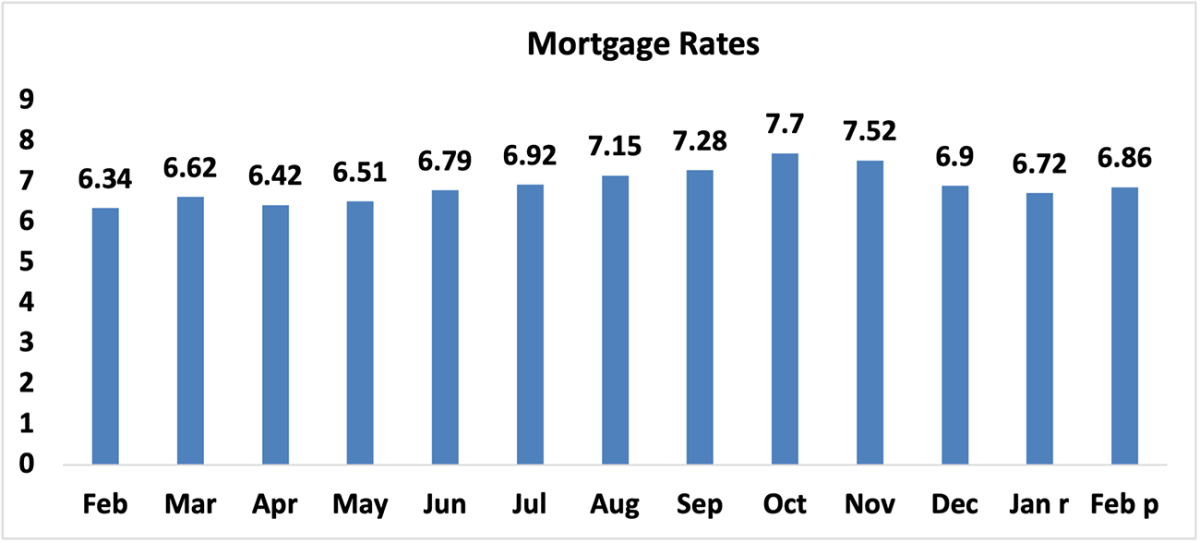

Compared to one year ago, affordability fell in February as the monthly mortgage payment climbed by 11.5% and median family income rose by 5.1%. The effective 30-year fixed mortgage rate was 6.86% this February compared to 6.34% one year ago. Nationally, mortgage rates were up 52 basis points from one year ago (one percentage point equals 100 basis points). Mortgage rates moved below 7% for the third consecutive month. The median existing-home sales price rose 5.6% from $368,100 compared to the sales price one year ago of $388,700.

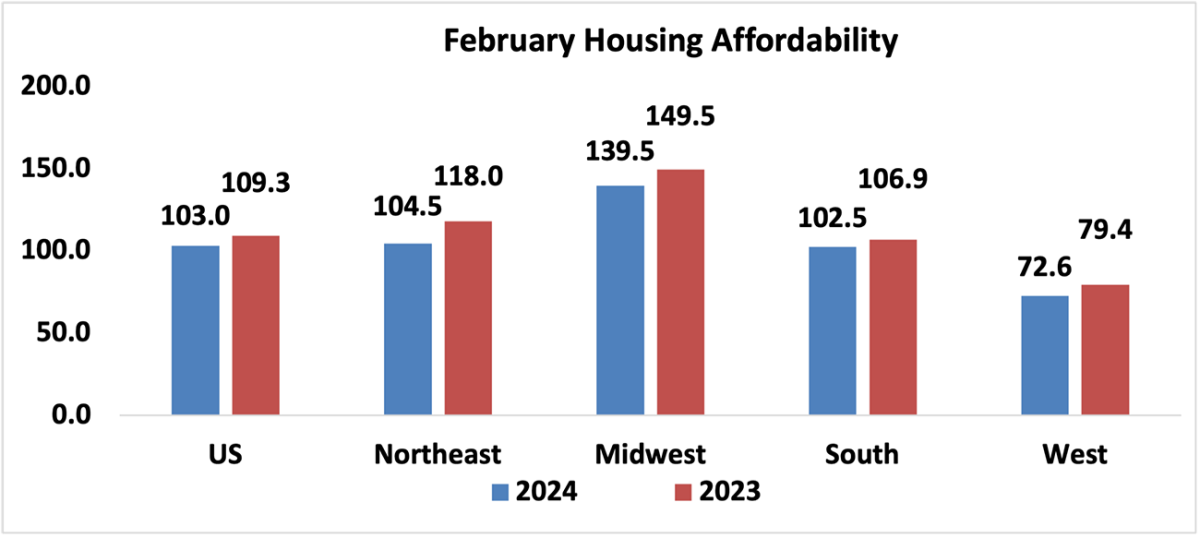

The national index is currently above 100, meaning the typical family can afford to buy based on the median-priced home. An index below 100 means that a family with a median income had less than the income required to afford a median-priced home. A mortgage is affordable if the mortgage payment (principal and interest) amounts to 25% or less of the family’s income.

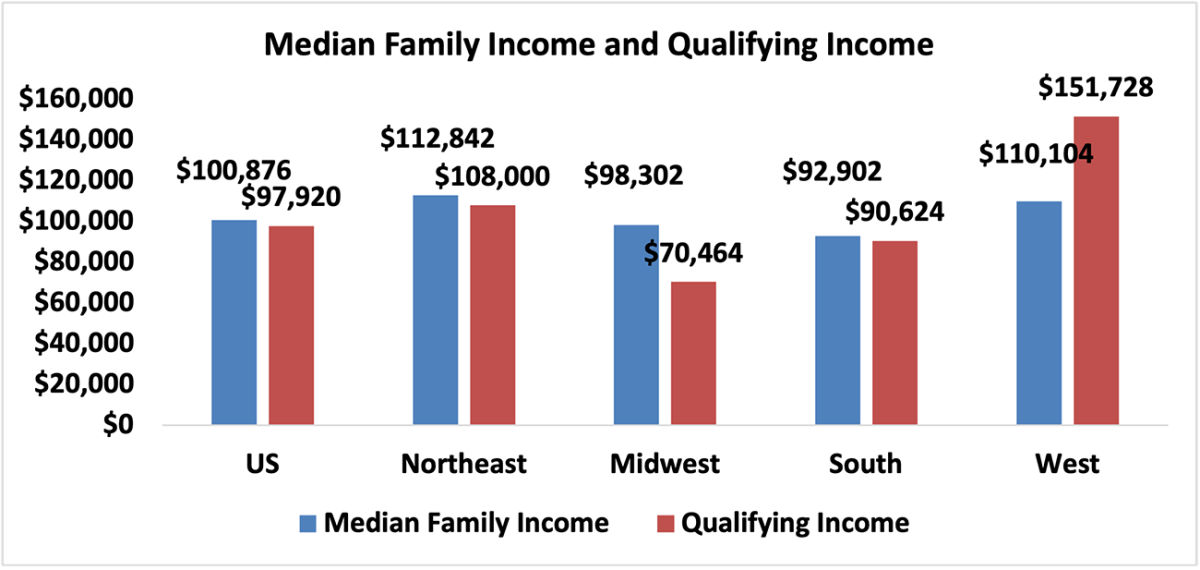

The most affordable region was the Midwest, with an index value of 139.5 (median family income of $98,302 with a qualifying income of $70,464). The least affordable region remained the West, where the index was 72.6 (median family income of $110,104 and the qualifying income of $151,728). The Northeast was the second most affordable region with an index of 104.5 (median family income of $112,842 and a qualifying income of $108,000). The South was the second most unaffordable region with an index of 102.5 (median family income of $92,902 with a qualifying income of $90,624).

Housing affordability declined in all four regions from a year ago. The Northeast region had the biggest decline of 11.4%, followed by the West, with a dip of 8.6%. The Midwest experienced a weakening in price growth of 6.7%, followed by the South, which fell 4.1%.

Affordability rose in three of the four regions from last month. The South region had the biggest gain, 4.1%, followed by the West, with an increase of 4.0%. The Midwest region had an increase of 3.3%, followed by the Northeast region, with a modest gain of 0.6%.

Compared to one year ago, the monthly mortgage payment rose to $2,040 from $1,830, an increase of 11.5% or $210. The annual mortgage payment as a percentage of income increased to 24.3% this February from 22.9% a year ago. Regionally, the West has the highest mortgage payment to income share at 34.5% of income. The South had the second-highest share at 24.4%, followed by the Northeast at 23.9%. The Midwest had the lowest mortgage payment as a percentage of income at 17.9%.

This week, the Mortgage Bankers Association reported that mortgage applications increased 3.3% from one week prior and 6.2% from a year ago. The rise in mortgage rates has raised monthly payments, hindering affordability. Home prices are slightly outpacing incomes, but income growth has been steady.

The Housing Affordability Index calculation assumes a 20% down payment and a 25% qualifying ratio (principal and interest payment to income). See further details on the methodology and assumptions behind the calculation.

Categories

Recent Posts

5966 Fairview Rd, Suite 400, Charlotte, NC, 28210, United States