Instant Reaction: CPI, April 10, 2024

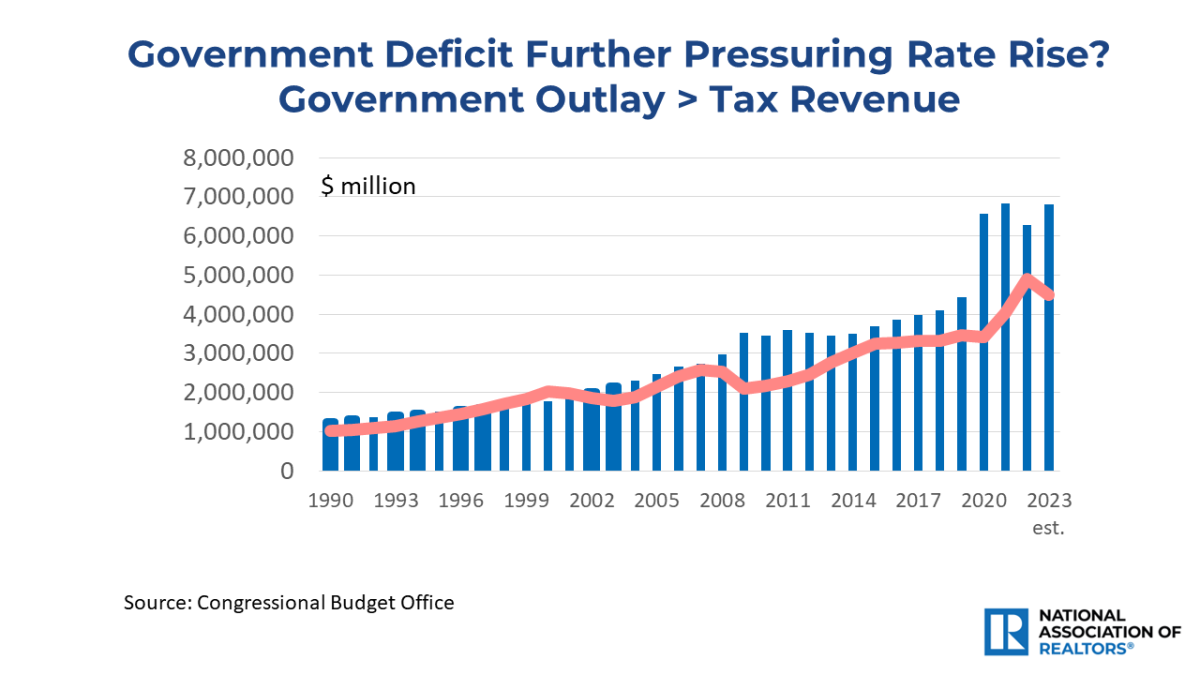

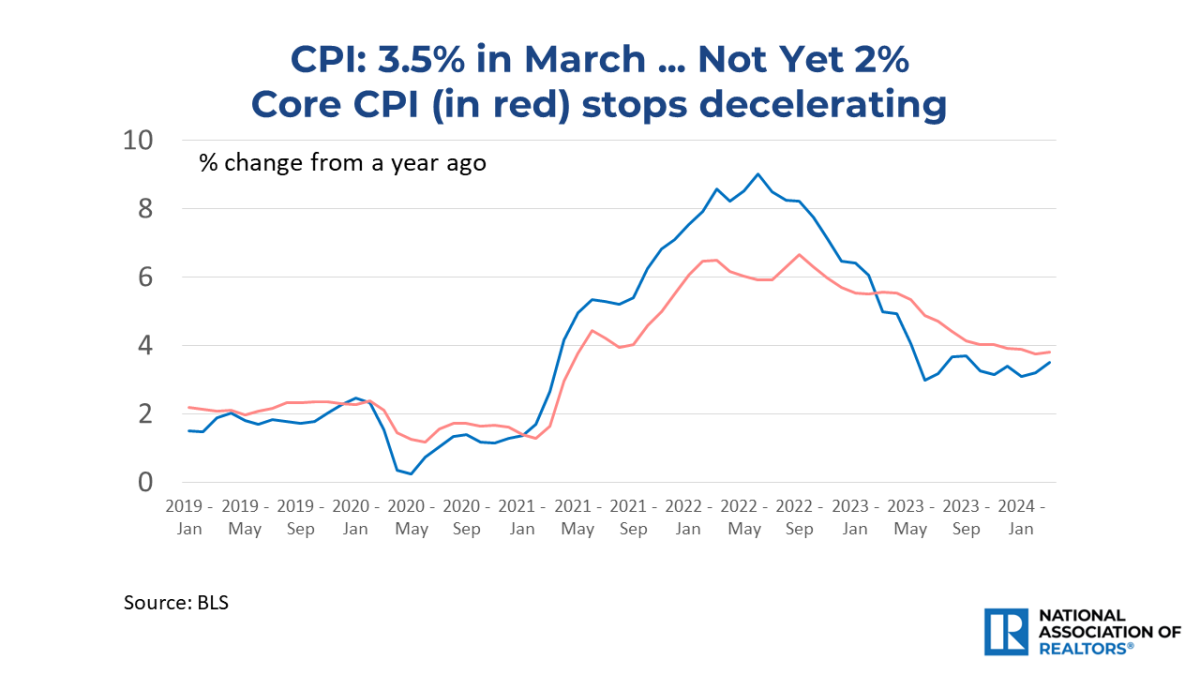

March inflation figures were very bad, which also means bad news for interest rates. Consumer prices reaccelerated to 3.5%. This is higher than the 2% target inflation, which raises eyebrows regarding the Federal Reserve's delay in cutting interest rates. The bond market immediately responded with high yields to compensate for the loss in purchasing power. Mortgage rates, unfortunately, will move a notch higher and are likely to cross above 7% in the upcoming weeks. In addition, the gigantic federal budget deficit will soak up more borrowing, thereby leaving less for mortgage borrowing.

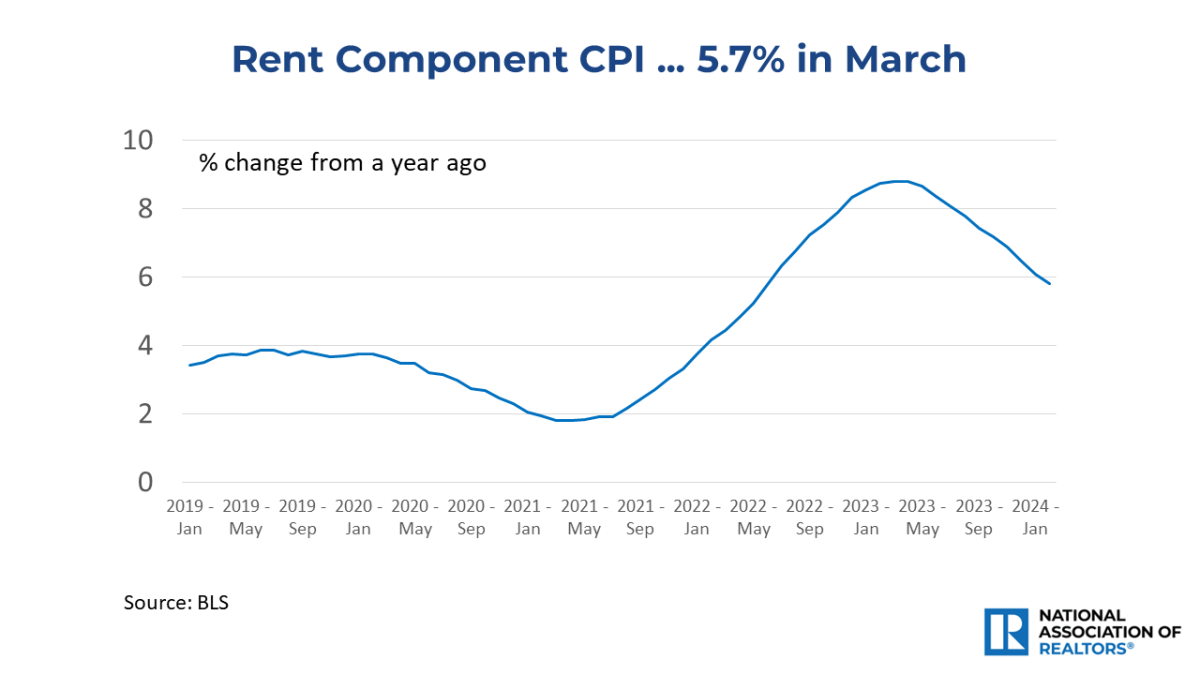

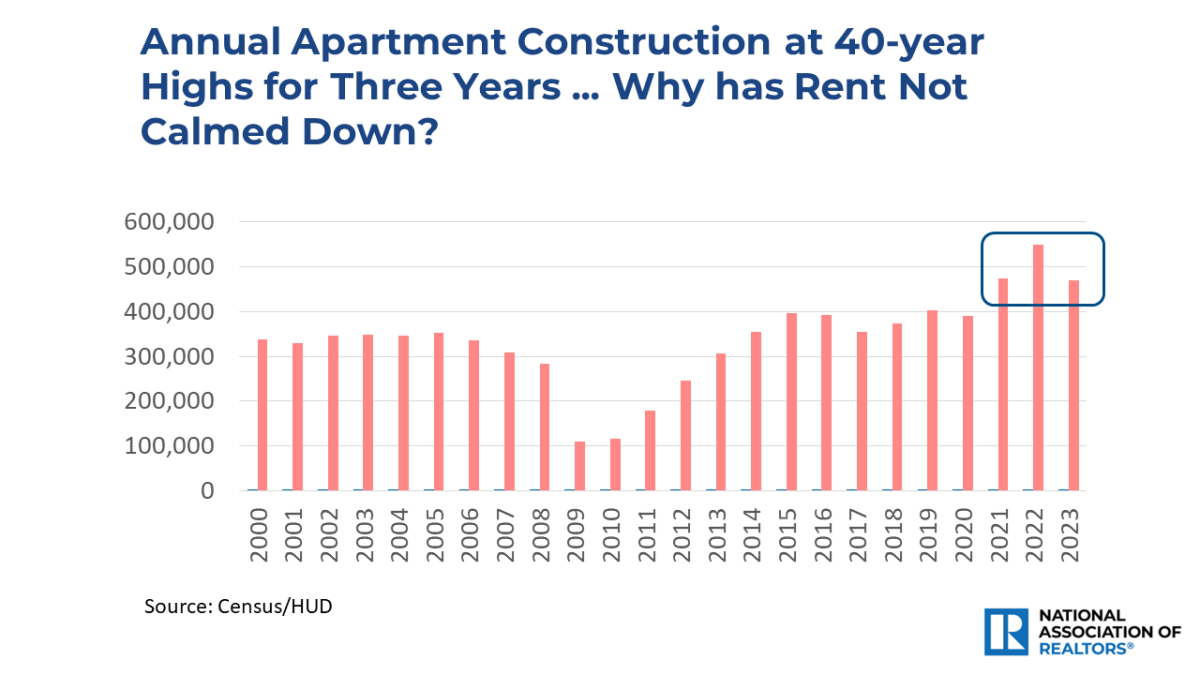

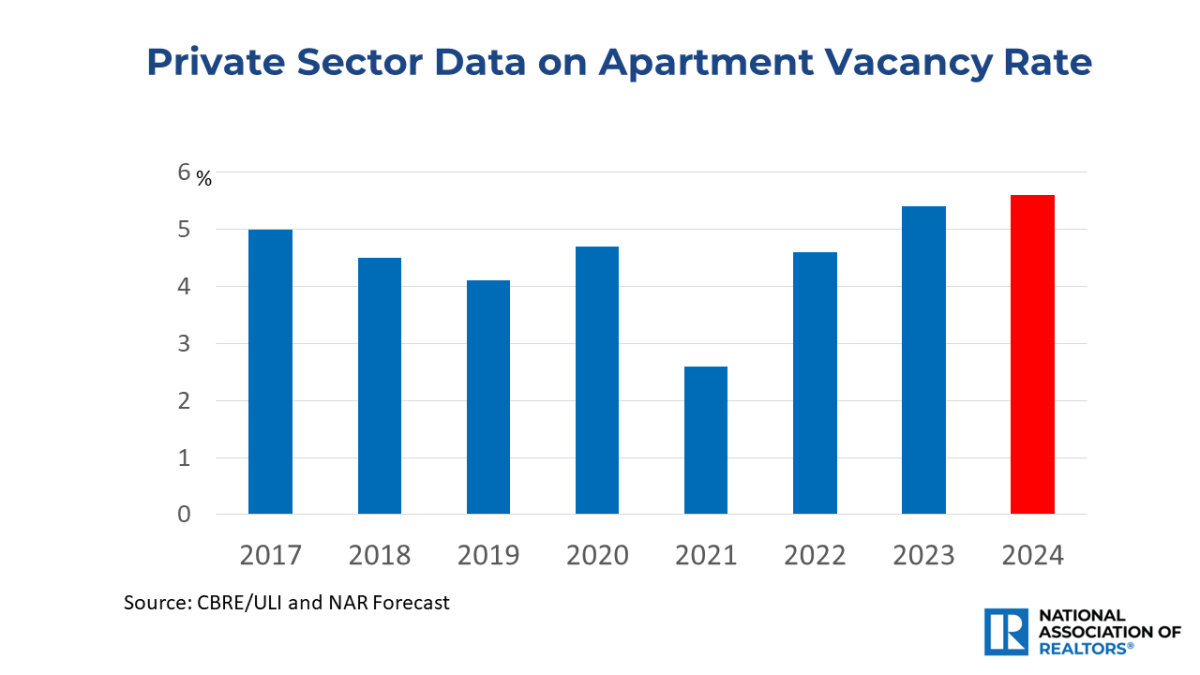

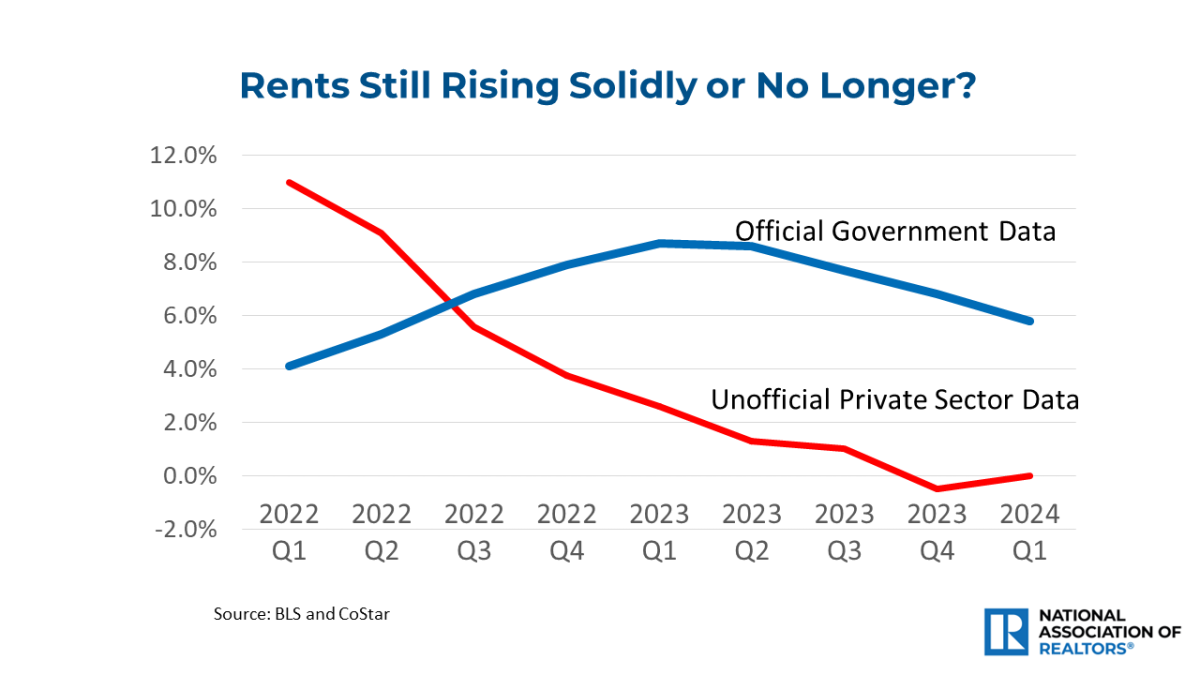

One strange data point is rent, which the official data shows at 5.8%. The unofficial data from the apartment industry indicates falling rent due to over-construction. If rent data calms, then overall inflation will automatically be lower. It is, therefore, possible to get to the 2% inflation target by year's end, even with bumps and delays.

Categories

Recent Posts

5966 Fairview Rd, Suite 400, Charlotte, NC, 28210, United States