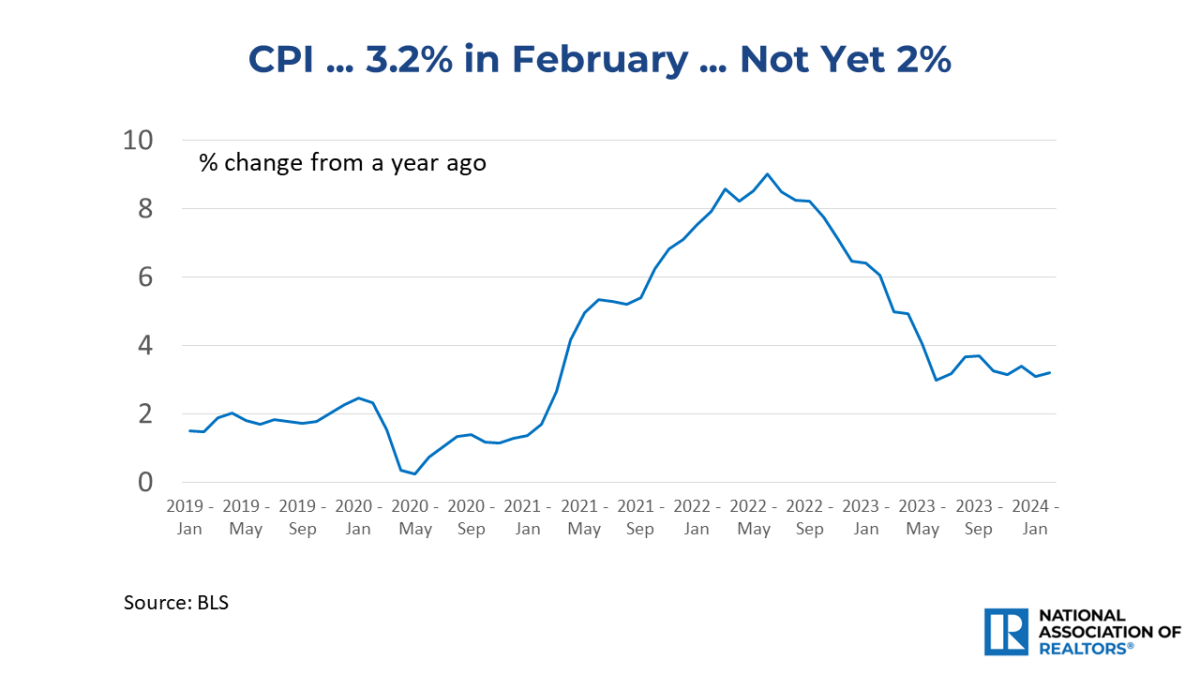

Instant Reaction: CPI, March 12, 2024

Consumer prices are rising at a slower rate than in most of the last three years, but still above the Federal Reserve’s desired target of 2%. In February, CPI rose by 3.2%. The important “core inflation” component rose by 3.75%, its lowest reading since April 2021. The heavyweight component of housing/shelter decelerated to 5.7%, thereby keeping the overall CPI above the 2% target, though many unofficial private sector data have been implying much lower rent growth.

The latest data does not fundamentally change what the Fed will likely do – 3 rate cuts this year. However, with anticipated further easing in inflation, especially as rents in the official measurement are showing calming patterns, 5 to 8 rounds of rate cuts by the end of next year will help lower mortgage rates. The one big limiting factor is the large budget deficit. More government borrowing will mean fewer funds are available for mortgage borrowing. There is a good possibility that mortgage rates will head toward 6%, but they will be hard-pressed to go down further.

Categories

Recent Posts

5966 Fairview Rd, Suite 400, Charlotte, NC, 28210, United States