Instant Reaction: Consumer Price Inflation, January 11, 2024

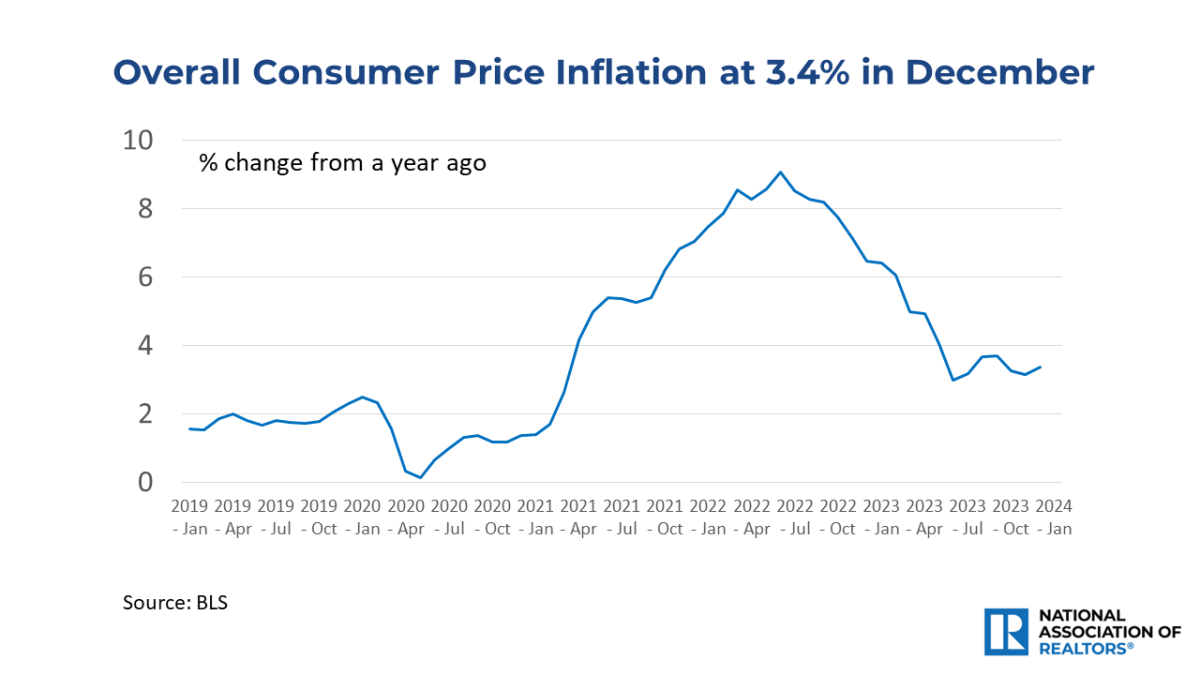

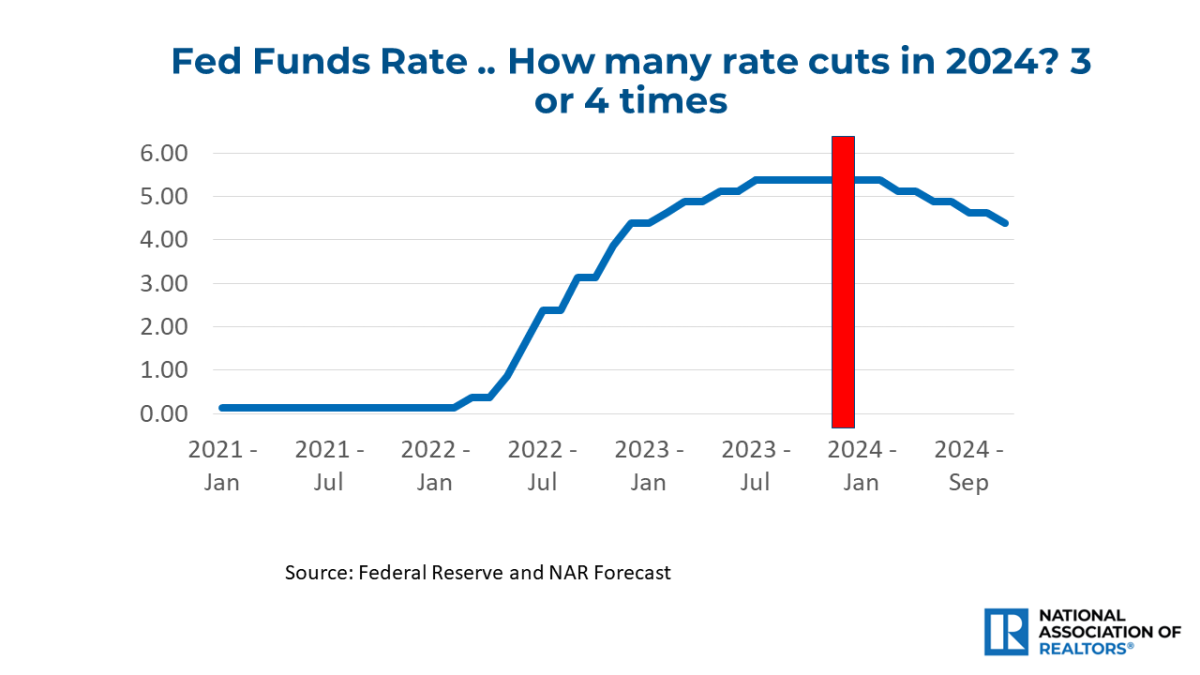

Consumer price inflation rose 3.4% in December, which is a bit higher than the 3.1% recorded in November. But the longer-term underlying trend is clear, with inflation being much calmer now compared to 2022. The latest inflation numbers do not change the trajectory of the Federal Reserve cutting interest rates by at least three times this year.

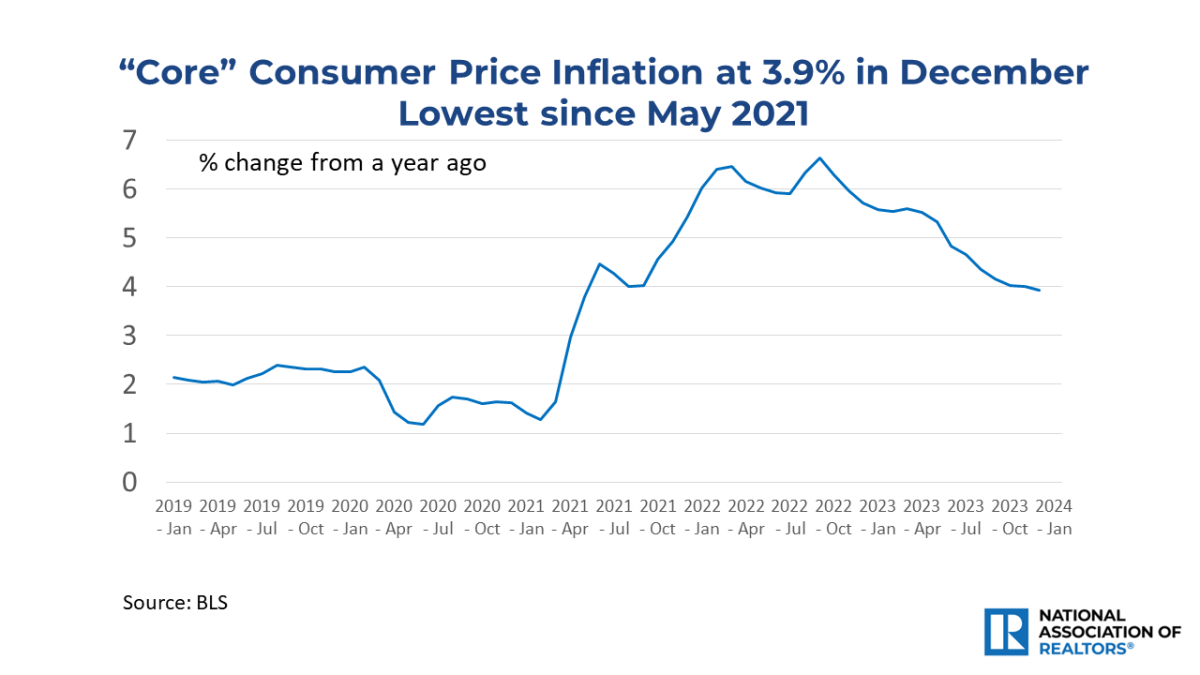

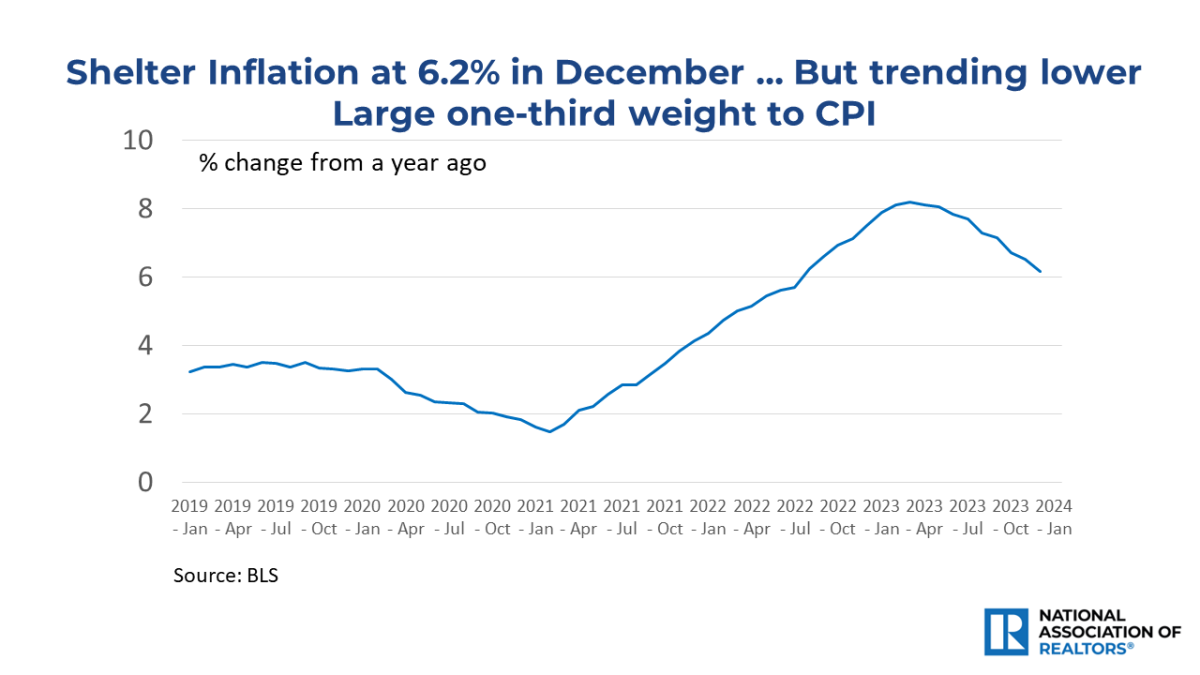

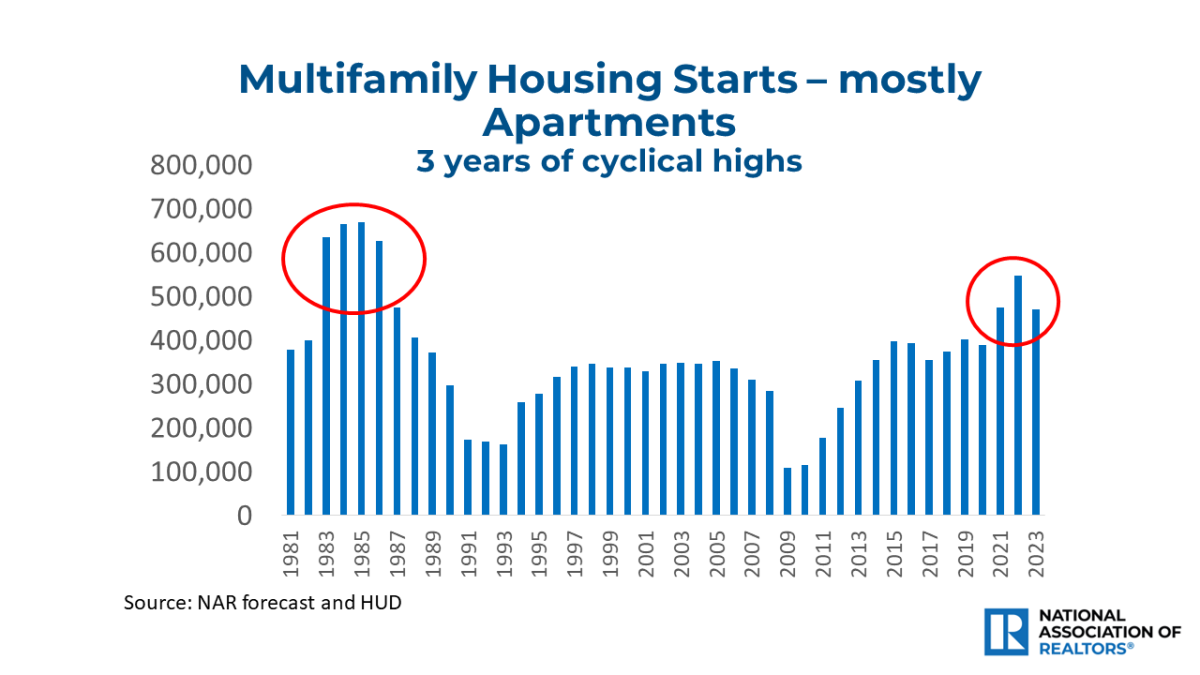

Housing rent, an important component, is trending calmer. That is why the key core inflation, which strips out the volatile energy and food components, slid to a 3.9% annual gain, its smallest rise in nearly 3 years. The Federal Reserve cares more about the "core" inflation. Hence, it could be more aggressive in cutting interest rates later this year, especially if the rent shows further cooling in the upcoming months. The apartment construction boom is implying as such.

Home prices are not part of consumer price inflation. Housing affordability, however, will be improved if mortgage rates fall.

Categories

Recent Posts

5966 Fairview Rd, Suite 400, Charlotte, NC, 28210, United States