Instant Reaction: Jobs, January 5, 2024

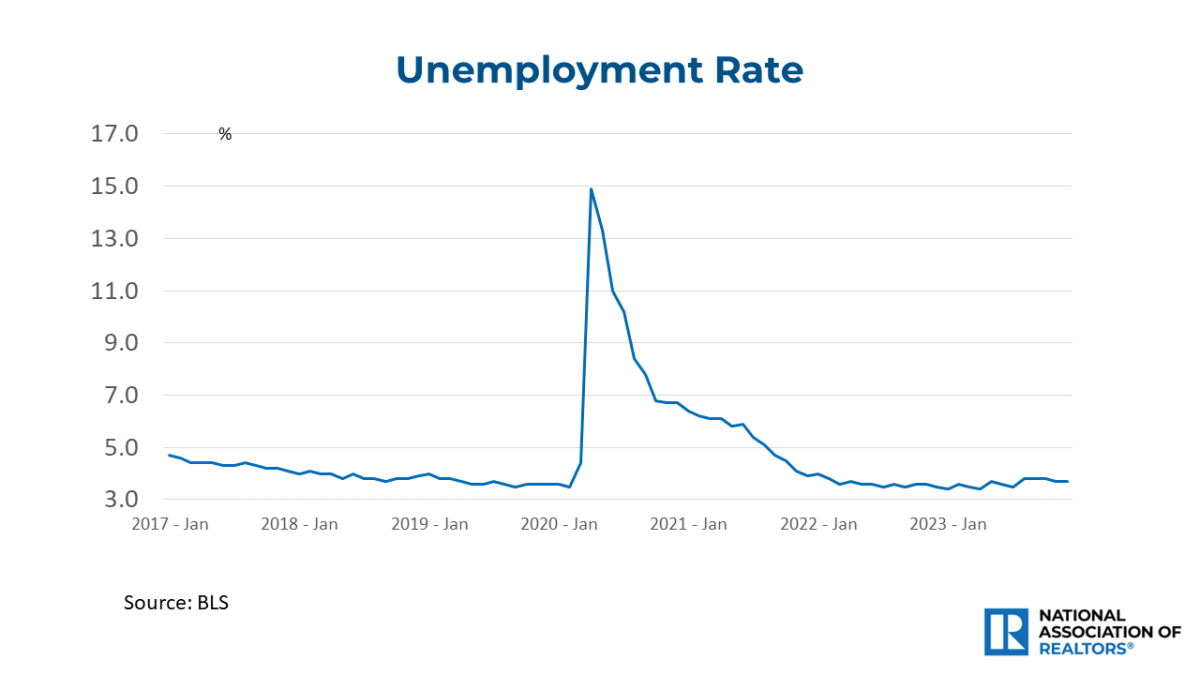

There is mixed news on the latest jobs figures. According to the household survey, there were 683,000 fewer Americans working in December. Despite that, the unemployment rate held steady at 3.7% because 845,000 left the labor force and were not even searching for a job. This survey data is considered bouncy and less reliable than company payroll data, showing a jobs gain of 216,000. Moreover, the latest average hourly earnings rose by 4.1% to $34.27. This is an acceleration from the previous month of 4.0%, though down from 4.8% a year ago.

Wall Street emphasizes the more reliable payroll data and the wage inflation pressure. Consequently, the bond market believes the Federal Reserve will be more cautious about lowering interest rates this year. The benchmark 10-year Treasury yield has been pushed up a bit, which inevitably means that the recent declines in mortgage rates are over until more economic data points toward softer inflation. In addition to the job market, the U.S. government is looking to sell more bonds to finance its huge budget deficit. It may have to offer higher interest rates to entice more bond buyers. Some bond investors are also nervous about the possible government shutdown.

All in all, jobs are being added, raising long-term housing and commercial real estate demand. However, short-term dynamics are more influenced by the movements in mortgage rates and the bond market.

Categories

Recent Posts

5966 Fairview Rd, Suite 400, Charlotte, NC, 28210, United States