Instant Reaction: Jobs, May 3, 2024

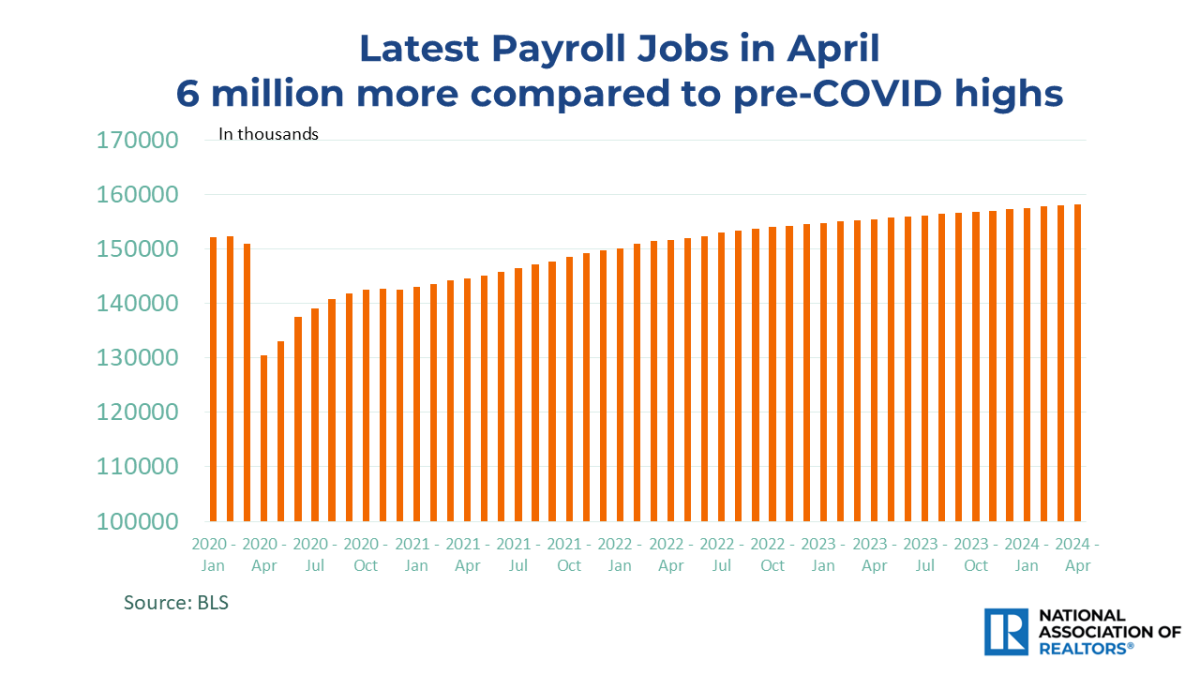

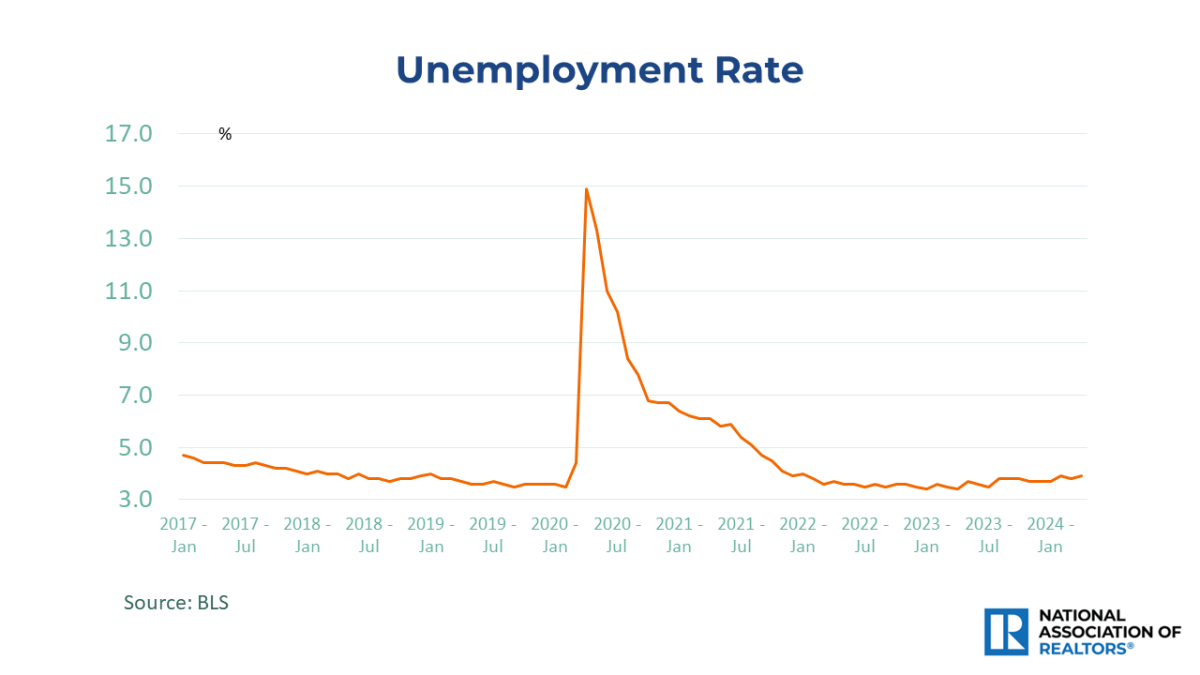

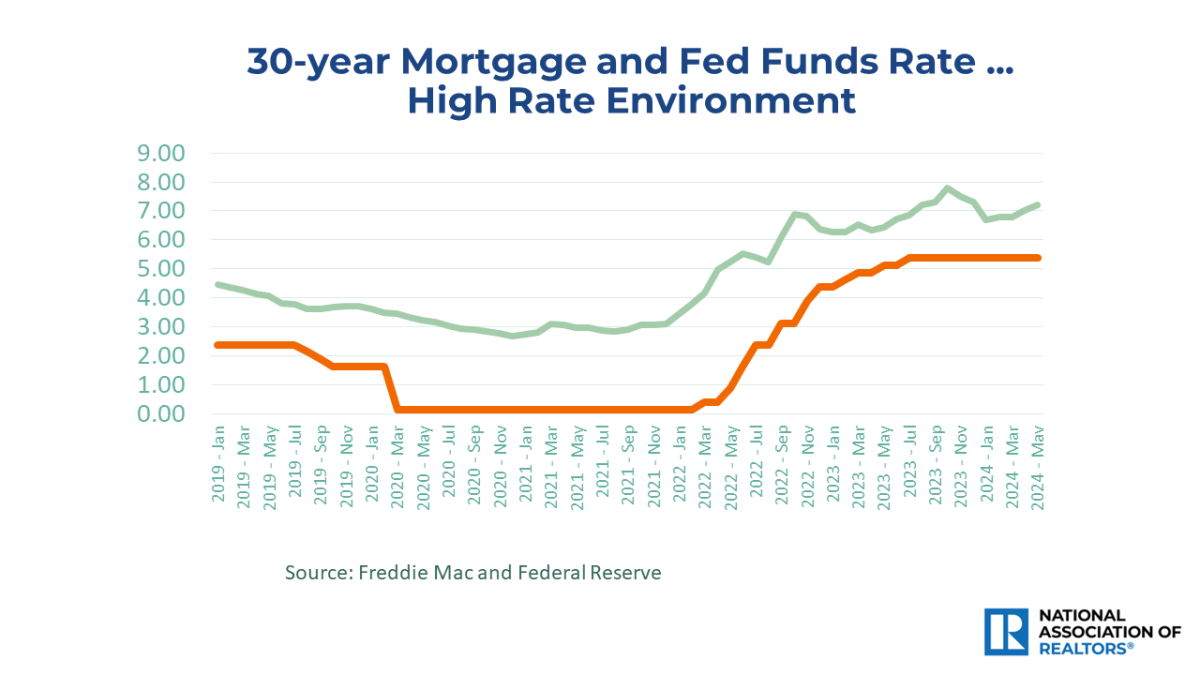

An economy that is too hot is not good for interest rates. Hence, the latest news of some cooling in the labor market could mean the topping-out of mortgage rates this week before more sustained declines through the remainder of this year. In April, the economy added 175,000 net new payroll jobs, one of the slower monthly job gains since the reopening of the economy after the COVID-induced lockdown. The unemployment rate ticked higher to 3.9%.

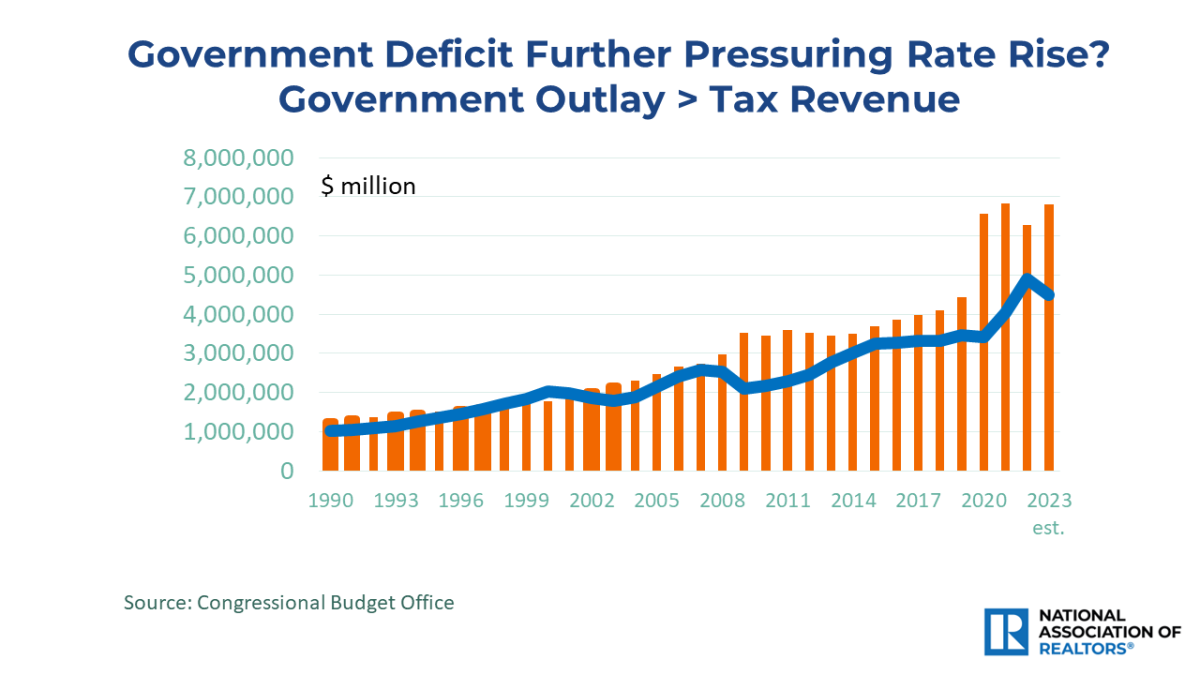

The Federal Reserve is delaying and is cautious about inflation, but 6 to 8 rounds of rate cuts through the end of 2025 are likely to bring the interest rates down from current high levels to match those during the pre-COVID years. Do not expect any major declines in mortgage rates, however. The federal budget deficit is massive. Heavy government borrowing will mean less money available for mortgage lending.

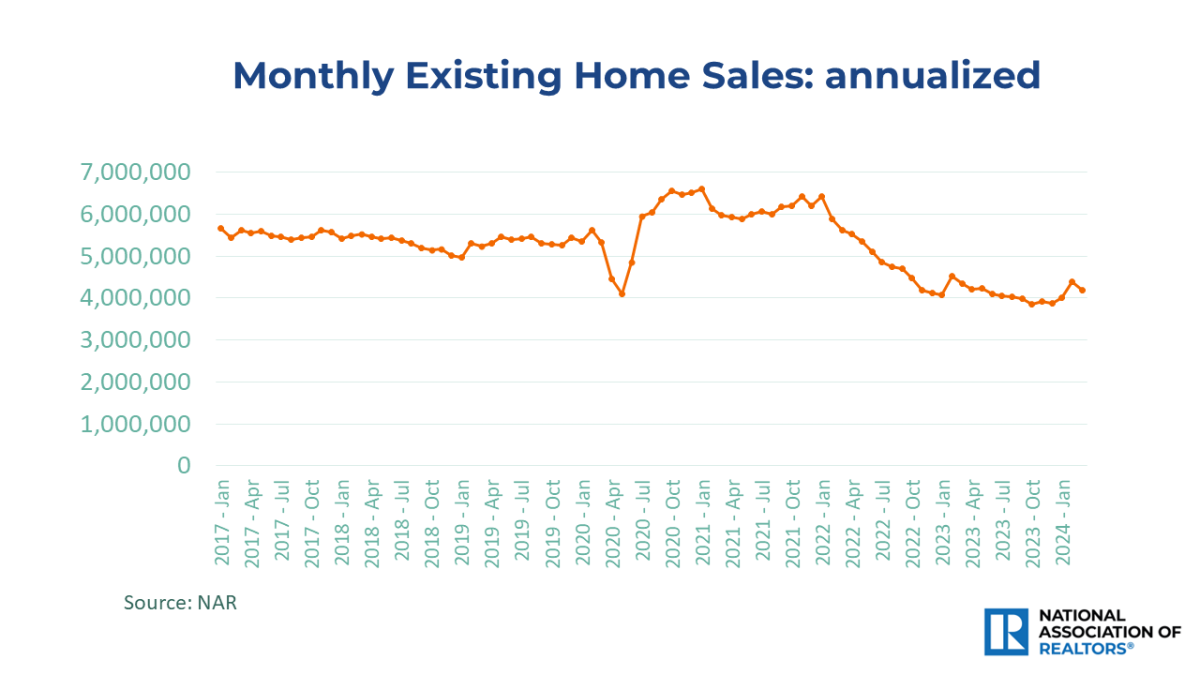

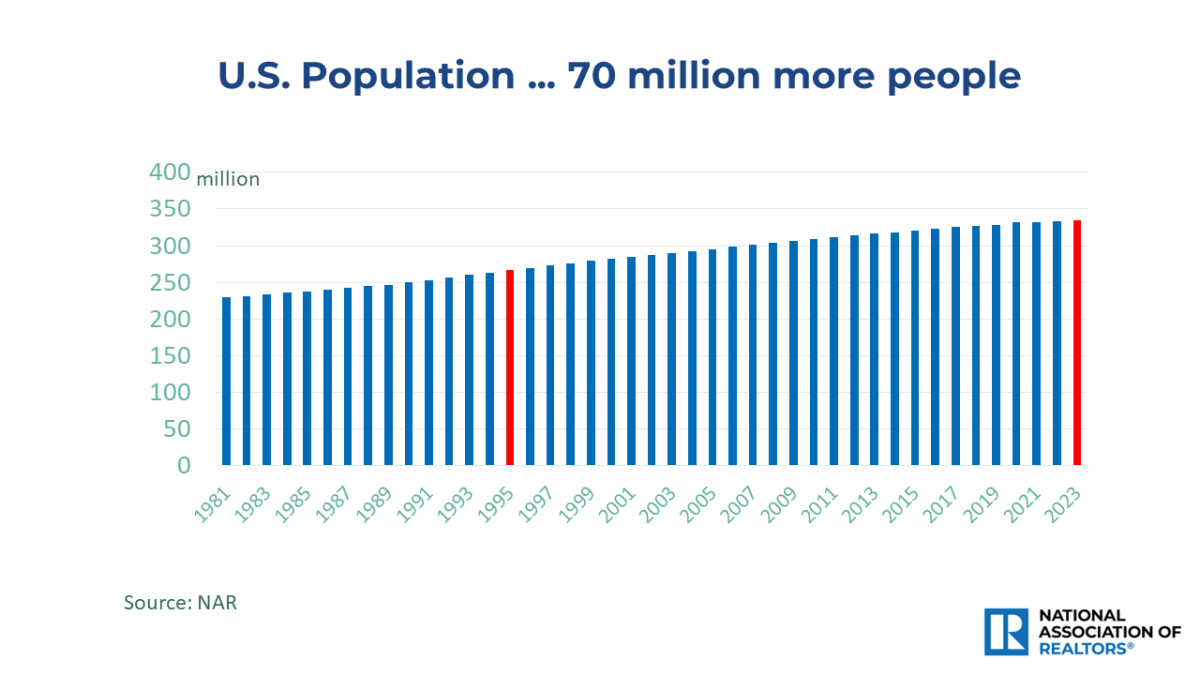

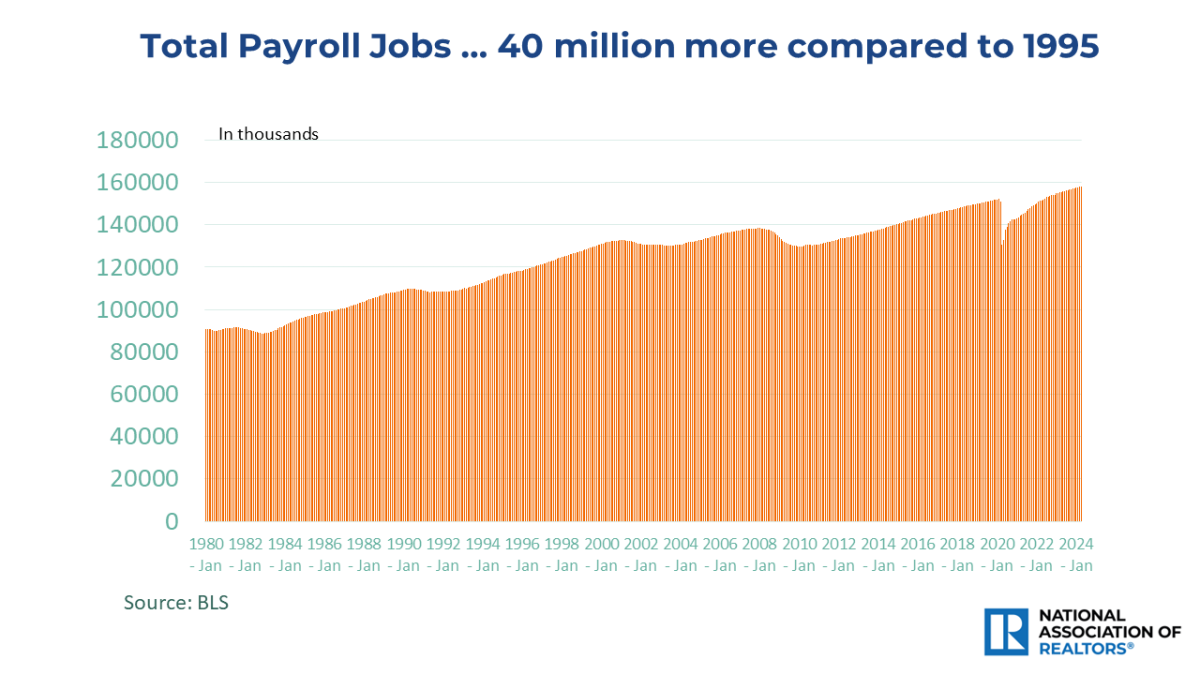

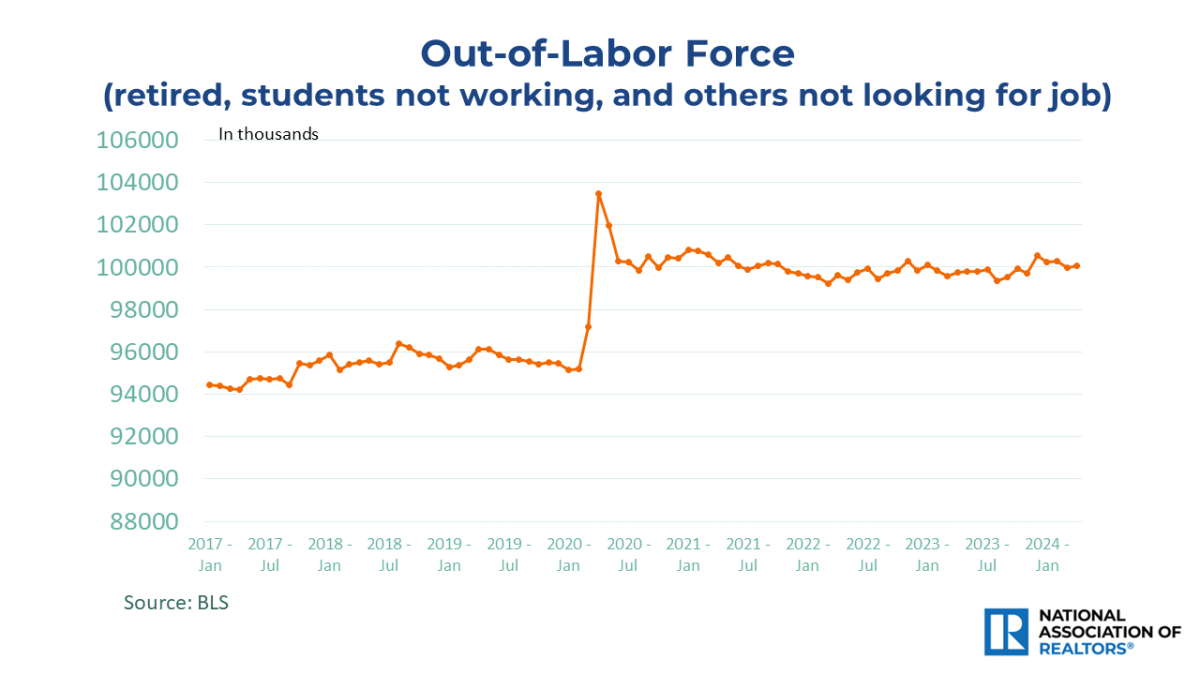

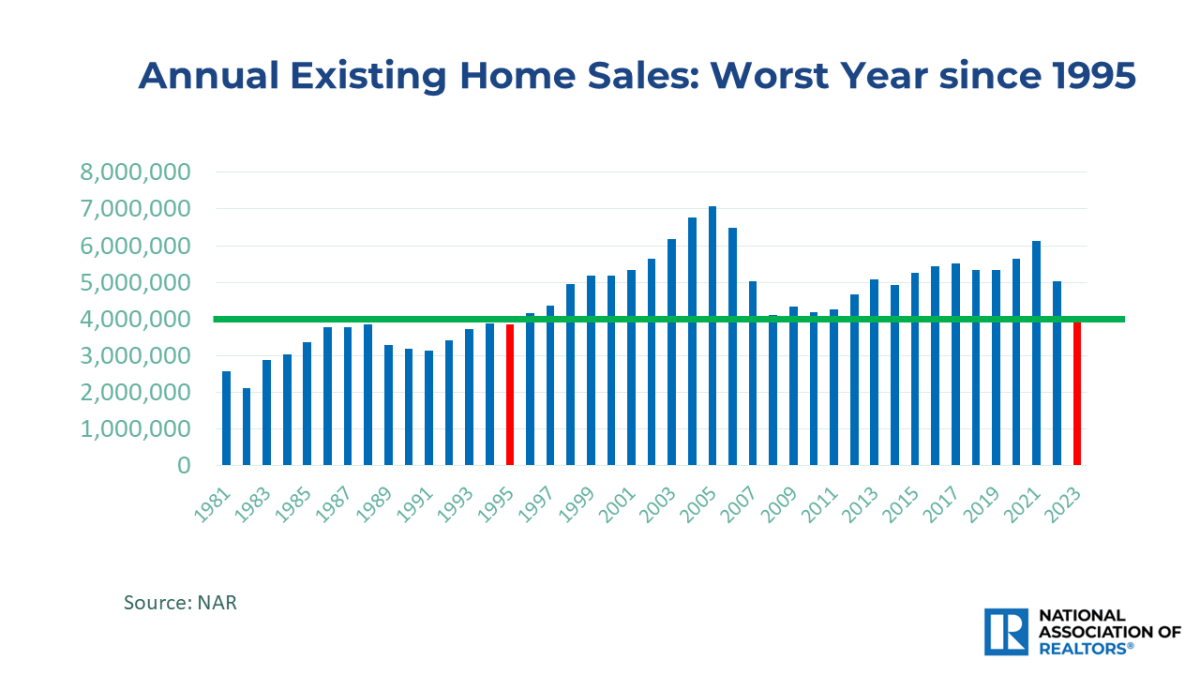

Home sales were at near 30-year lows last year and still scratching along at that rate in the first quarter of this year. But there are 40 million more jobs and 70 million more people living in the country now compared to then. That is, there is a sizable stored-up housing demand to be released into the market in the upcoming years.

Categories

Recent Posts

5966 Fairview Rd, Suite 400, Charlotte, NC, 28210, United States