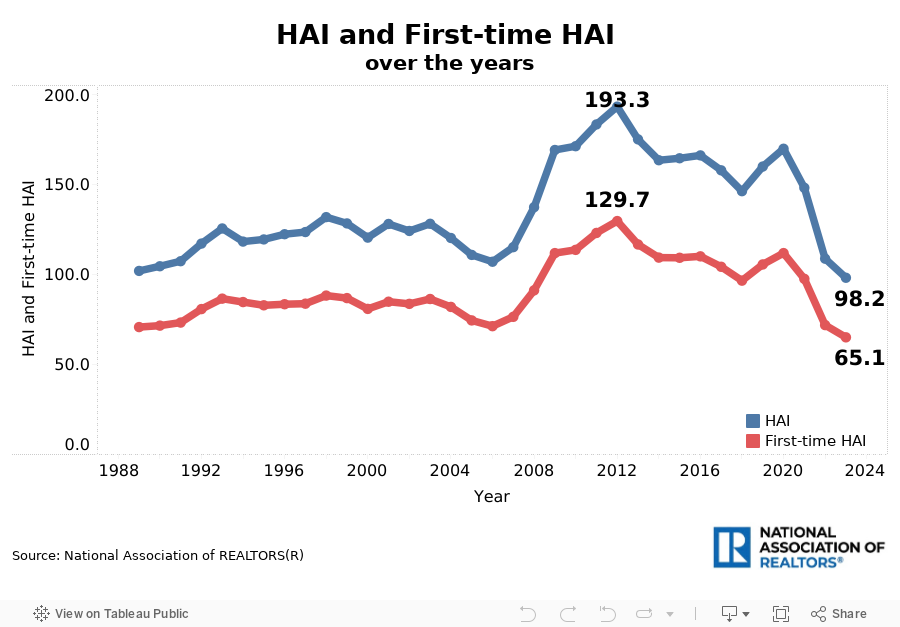

Mortgage Rates Push Housing Affordability Down in March 2024

According to NAR's Housing Affordability Index, housing affordability weakened nationally in March compared to the previous month. The monthly mortgage payment increased by 2.8%, while the median price of single-family homes increased by 2.4%. The monthly mortgage payment increased by $57 from last month.

Compared to one year ago, affordability fell in March as the monthly mortgage payment climbed by 7.7% and median family income rose by 5.2%. The effective 30-year fixed mortgage rate was 6.90% this March compared to 6.62% one year ago. Nationally, mortgage rates were up 28 basis points from one year ago (one percentage point equals 100 basis points). Mortgage rates moved below 7% for the fourth consecutive month. The median existing-home sales price rose 4.7% to $397,200 compared to one year ago ($379,500).

The national index is currently above 100, which means that the typical family can afford to buy a median-priced home. An index below 100 means that a family with a median income had less than the income required to afford a median-priced home. The income required to afford a mortgage, or the qualifying income, is the income needed so that mortgage payments on a 30-year fixed mortgage loan with a 20% down payment account for 25% of family income. The most affordable region was the Midwest, with an index value of 132.8 (median family income of $98,964 with a qualifying income of $74,544). The least affordable region remained the West, where the index was 71.5 (median family income of $110,845 and the qualifying income of $155,136). The Northeast was the second most affordable region with an index of 102.0 (median family income of $113,602 and a qualifying income of $111,360). The South was the second most unaffordable region with an index of 101.6 (median family income of $93,528 with a qualifying income of $92,064).

A mortgage is affordable if the mortgage payment (principal and interest) amounts to 25% or less of the family’s income.

Housing affordability declined in all four regions compared to a year ago. The Northeast region had the biggest decline, 7.4%, followed by the Midwest, which dipped by 4.9%. The West experienced a weakening in price growth of 3.9%, followed by the South, which fell 0.6%.

Affordability fell in all four regions from last month. The Midwest region had the biggest decline, 4.3%, followed by the Northeast, which decreased 2.4%. The South and West regions both experienced a reduction of 1.5%.

Compared to one year ago, the monthly mortgage payment rose to $2,093 from $1,943, an increase of 7.7% or $150. The annual mortgage payment as a percentage of income inclined to 24.7% this March from 24.2% from a year ago. Regionally, the West has the highest mortgage payment to income share at 35.0 of income. The South had the second-highest share at 24.6%, followed by the Northeast at 24.5%. The Midwest had the lowest mortgage payment as a percentage of income at 18.8%.

This week, the Mortgage Bankers Association reported that mortgage credit availability increased in March. Last week, the Mortgage Bankers Association reported that mortgage applications decreased 2.3% from one week prior. Higher mortgage rates and rising home prices are hurting affordability conditions. Meaningful gains in housing inventory will help potential home buyers.

The Housing Affordability Index calculation assumes a 20% down payment and a 25% qualifying ratio (principal and interest payment to income). See further details on the methodology and assumptions behind the calculation.

Categories

Recent Posts

5966 Fairview Rd, Suite 400, Charlotte, NC, 28210, United States