Young Adults Are Living at Home, but Homeownership Could Be Their Next Address

After dropping for two consecutive years, the share of young adults living at home is back on the rise. But, before parents despair, there may be a silver lining to young adults boomeranging—this might make it easier to save for a down payment on a home. First-time buyers who live in the nest have lower household incomes but are less likely to cite saving for a down payment as the most difficult step in the buying process.

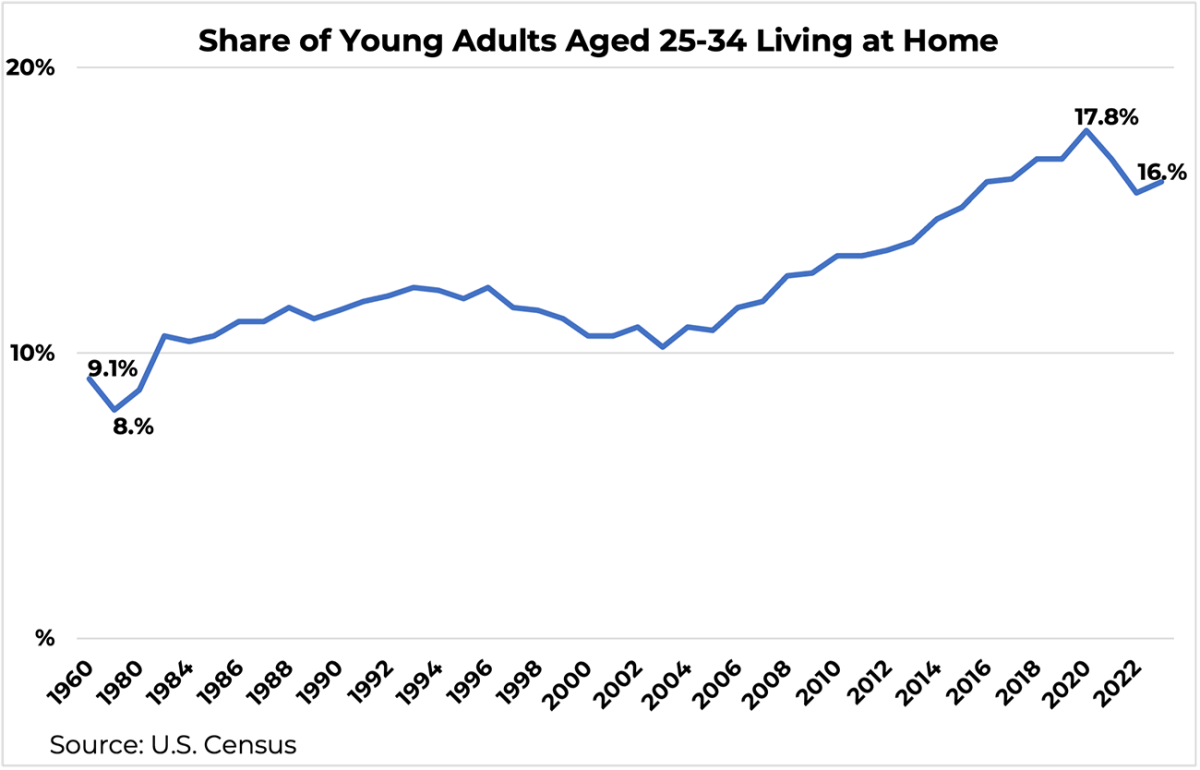

In 2023, 16% of young adults aged 25 to 34 lived at home with family. In 2020, the share of young adults aged 25 to 34 living at home grew to the highest share recorded since 1960, 17.8%. Historically, between 1960 and 1980, the share of 25- to 34-year-olds living at home was less than 10%. Some young adults may be forced to live at home due to high rent, while others have the benefit and flexibility of remote work. Regardless of the reason, this may benefit potential first-time home buyers.

Moving home could give these young adults a financial boost they would not have had otherwise. It could have translated into savings, paying down existing debt, and working on their credit scores and debt-to-income ratio. Among student debt holders, 6% cited the that the pandemic allowed them to pay off their student debt earlier or get closer to paying it off directly because they moved in with family and avoided rent. For some, it may even have allowed them to save for a down payment on a home.

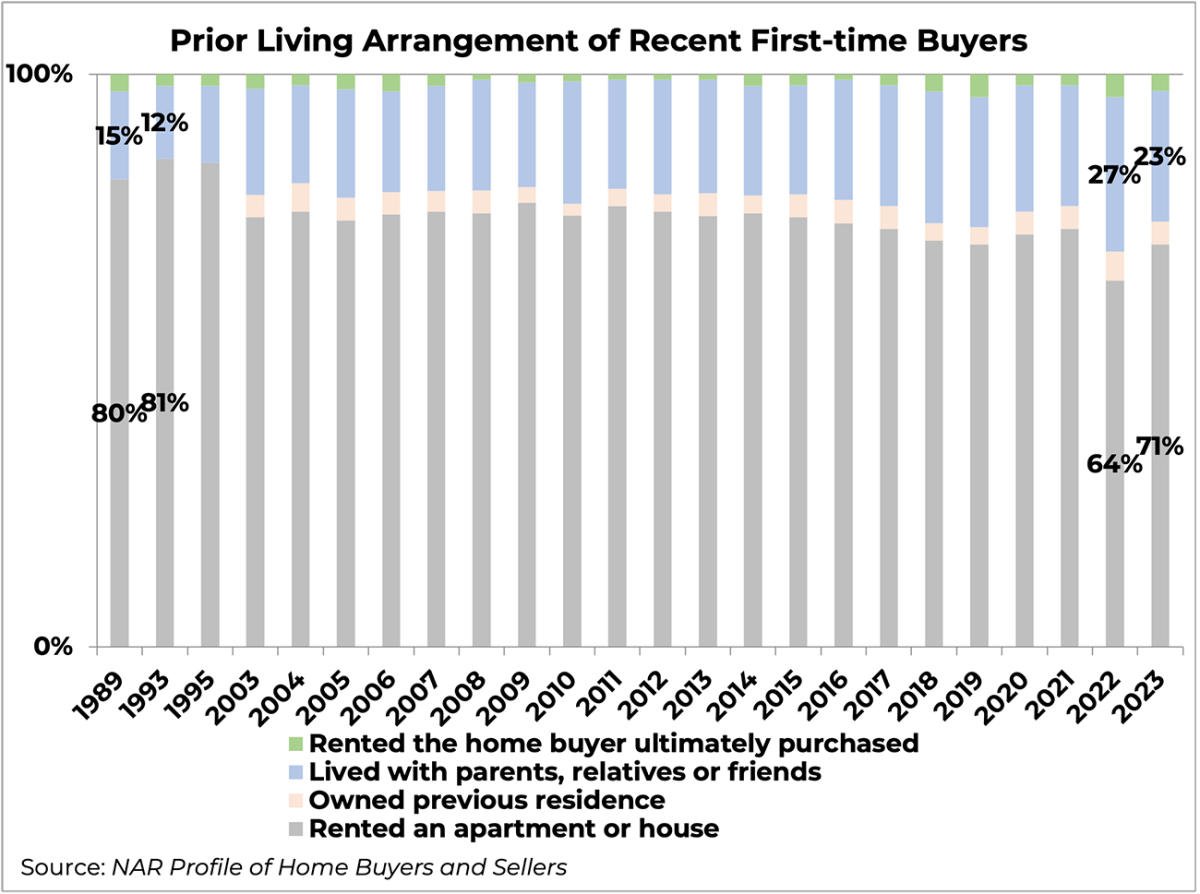

When examining historical trends, first-time buyers are most likely to rent before purchasing a home. This year, the share that rented before buying remained the majority at 71%. But the share moving from a family member's home is nearly one-quarter of first-time buyers. Since 2016, however, there has been an elevated share of buyers who are moving directly from a family member's home into homeownership. This compares to 12% to 15% between 1989 and 1995 when NAR first started collecting the data series.

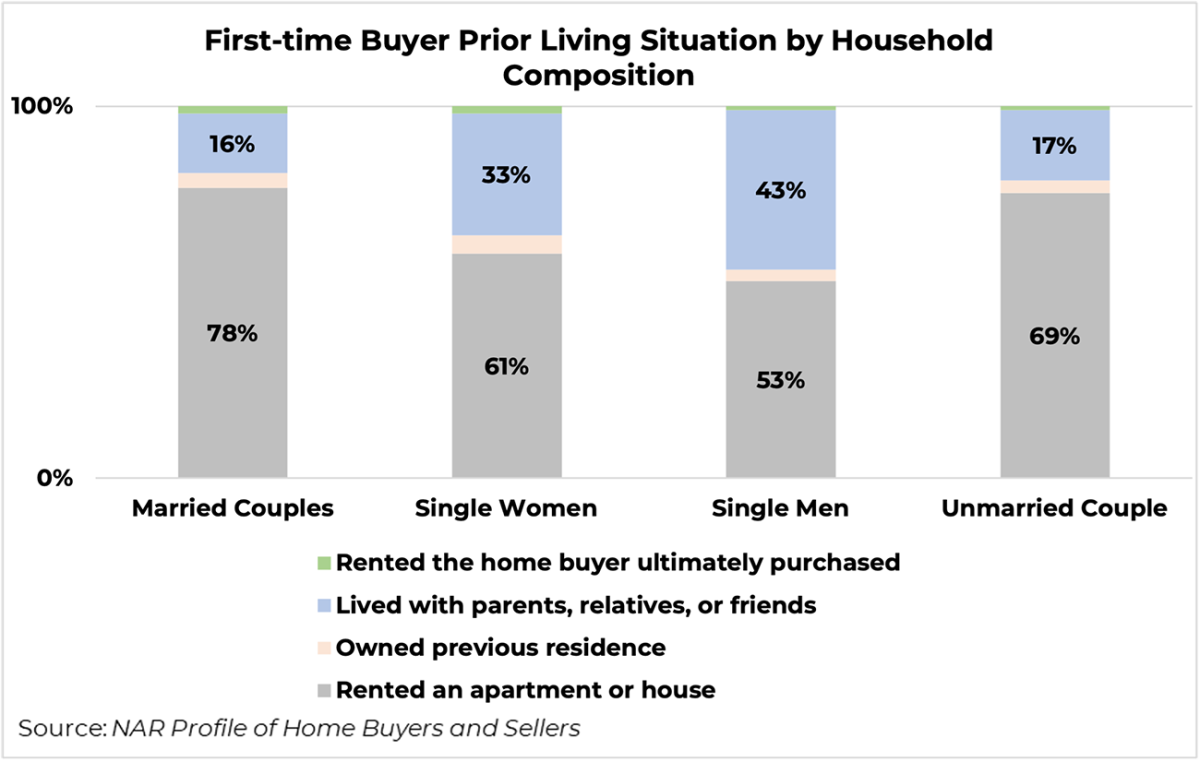

For first-time buyers who lived at home first, about half are making rent payments to family. NAR does not collect if this is fair market value rent, compared to contributing rental payments that may cover their share of utilities or groceries. By household composition, it is more common for single men and women who are first-time buyers to live with their families before purchasing. First-time buyers who lived with family before buying also tended to be younger, with a median age of 32, compared to those who rented, who had a median age of 36 years old.

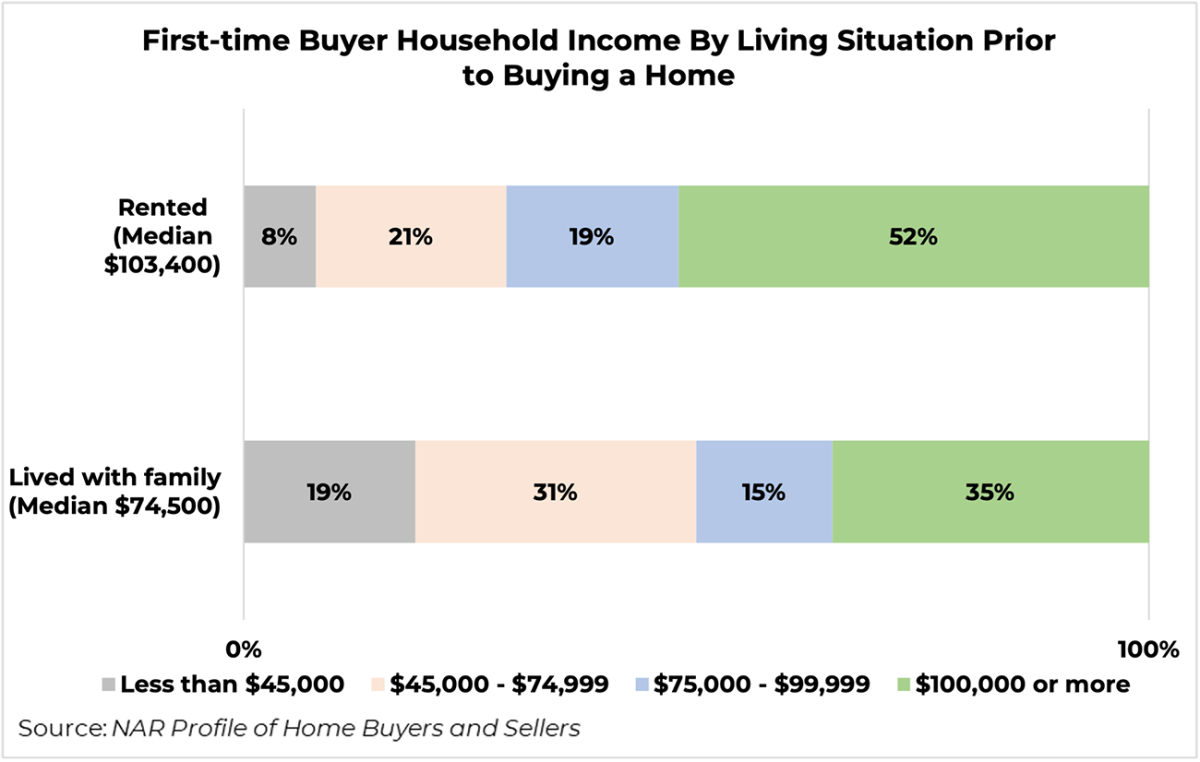

Living at home may not be an ideal, or even a long-term scenario for many families. However, if prospective first-time buyers can move back home before purchasing, this might financially help them save to purchase a home. This is more likely the case for buyers with more conservative household incomes. More than half of first-time buyers who rented before purchasing a home earned a household income above $100,000 and had a median household income of $103,400. Those who lived with family first had a median household income of $74,500. While first-time buyers who lived at home did have lower household incomes, they were less likely to cite saving for a down payment as a difficult step in the homebuying process. Among first-time home buyers who rented before buying, 40% said saving for a down payment was one of the most difficult tasks compared to 35% of those who lived with family first.

The added flexibility of living with family allows a buyer to navigate the tight housing market with limited affordable housing inventory. In December 2023, the typical home listed for sale had 2.4 offers, 16% sold above the list price, and 56% of homes sold in under one month. By living at home, the potential buyer can wait for an ideal home that fits their needs.

While this option is available for some young adults, it speaks to a larger housing market trend: those who can take advantage of willing family members to open their doors and those who cannot. As many workplaces transition to more in-office workdays from remote days, this could narrow the ability for many young adults to use this as a savings vehicle for their future homes.

Categories

Recent Posts

5966 Fairview Rd, Suite 400, Charlotte, NC, 28210, United States